FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

1 GENERAL PROVISIONS

The safeguarding policy describes how company would hold client’s funds and how would be done transaction flow. Safeguarding funds from payment services are done under the Payment Services Regulations 2017 (PSRs 2017). Purpose of safeguarding is to protect customers funds that are held by an institution. HIRETT ensures this by placing funds in a separate account in each credit institution where the company have opened accounts from the institution’s working capital and other funds.

European payments companies must take careful measures to meet their legal obligations given the differences in transposition and interpretation of the underlying European Directives and the variety of relevant Member State laws. HIRETT’s must undertake careful and continuous money management processes, this should include a Host State country and legal risk assessment and continuing review. Until the European e-money sector becomes more mature, HIRETT’s are encouraged to sweep regularly from any Host State accounts to their Home State since this provides the best practical guarantee for e-money holder funds. This guidance note highlights some complexities and potential deficiencies in current European payment law.

It is required that the electronic money institution safeguards the funds received from consumers as prescribed by its provisions and to keep separate accounts for the funds received from the consumers and the accounts for other natural and/or legal persons’ funds.

In case the funds are held by the applicant and not yet delivered to the payee (merchant) or transferred to another payment service provider by the end of the business day following the day when the funds have been received, they shall be deposited in a separate account in a credit institution or invested in secure liquid low-risk assets, them being:

- Risk free high-liquid assets

- Demand deposit at the credit institution of adequate rating or

- Debt securities issued by an issuer of adequate rating

The funds shall be covered by an insurance policy for an amount equivalent to that which would have been segregated in the absence of the insurance policy or other comparable guarantee, payable in the event that the payment institution is unable to meet its financial obligations.

1.2 RULES FOR DEPOSITING OF FUNDS

The funds, which will be deposited with the client company must be held separately from the company’s own funds and funds from other parties, with the exception of other funds that have been entrusted to the company for a payment transaction.

The provision of payment services by setting up a special account at a bank, savings and credit cooperatives, foreign banks established in a Member State or a foreign bank with its registered office in a non-Member State which is subject to supervision comparable to supervision of the United Kingdom Financial Conduct Authority. These accounts are designed exclusively for storage of customer funds and companies for the execution of payment transactions. These accounts may be used for storing and managing the company’s own resources and may not be used or to conduct any transactions other than the provision of payment services to clients whose funds are deposited in these accounts.

Specific rules for storage of customer funds in a segregated account companies are established for each type of payment services.

Activities in the provision of payment services

The Company will provide the following payment services:

- Execution of transfer of funds from the payment account

- Money remittance;

- Issuance of payment instruments, and devices for accepting payment instruments

- (2) activities that are directly related to the provision of payment services for the purposes of internal regulation means

- Acceptance of payment orders;

- Management of electronic banking;

- The transfer of funds;

- Issuance of checks.

2 SAFEGUARDING MEASURES

As the safeguard measure HIRETT has chosen to deposit the funds in a separate, settlement, account in a credit institution in European Union, preferably in an account held by the servicing bank. Namely, the segregation method will be used to protect client’s funds. The funds received in exchange for e-money (relevant funds) would be held separately from funds received from other business activities

Once the licence is obtained, HIRETT will formalise an agreement with its bank in European Union, which will keep separate accounts for HIRETT – settlement accounts for the funds received on behalf of the customers using HIRETT’s payment services (one settlement account for each currency).

Upon the termination of the holding period, funds will be transferred to customer’s current account after the deduction of HIRETT fee, which amount is transferred to HIRETT’s current account held for HIRETT’s profits (kept either with the acquirer or another bank with which an agreement will be made).

Transferring funds to the current account belonging to the customer is sole responsibility of HIRETT Authorized Electronic Money Institution.

2.1 Issuance & Redeemability

When funds are received by an Electronic Money Institution (“HIRETT”) from its clients for the purposes of obtaining e-money from the HIRETT, HIRETT must immediately issue (and redeem on request) e-money in accordance with the 2nd Emoney Directive E-Money Directive (2009/110/EC) (the ”2nd EMD” – for example, see Article 6 of the 2nd EMD). In addition, HIRETT must “safeguard funds that have been received in exchange for e-money that has been issued”. These are known as “relevant funds”.

2.2 Segregation & Preference

Relevant e-money liabilities are matched by safeguarded funds to ensure that the e-money client funds are protected. The safeguarding provisions are acting as a way of identifying and segregating preferred liabilities from other creditors of HIRETT. The effect is that the protection is in place to defeat other creditors of HIRETT (at any time) and in the event of insolvency it ensures easy ascertainment of a defined pool of secured assets that is available to meet the e-money liabilities in the first instance (i.e. requiring preferential treatment as against other creditors of an HIRETT).

2.3 Structure of the Safeguarding Requirements

HIRETT is required to safeguard e-money client funds using the specified method:

- by placing them in segregated accounts with suitable credit institutions and naming them as safeguarded accounts (Article 7 of 2nd EMD and Article 9 of the Payment Services Directive, Directive 2007/64/ EC. – “PSD”).

HIRETT is subject to both the PSD and the 2nd EMD in the pursuit of its authorised activities. However, given the purpose of the safeguarding requirements, HIRETT also maintains a continuing watch over these statutorily method of protection to ensure that the chosen method (including the chosen bank) continues to provide actual protection for the e-money holder liabilities (see e.g. Article 5 and Article 10 of the PSD).

2.4 Reconciliation

There is some statutory allowance for a short delay (one business day – see Article 7 of the 2nd E-money Directive and Article 9 of the PSD) in matching e-money liabilities with safeguarded liabilities. However, the e-money liability accrues immediately and this means that monies received by a person acting on behalf of the HIRETT (such as an agent or distributor), becomes an e-money liability as at the date of transfer of the cash (even before it is received by the HIRETT) even though a day’s grace is permitted for safeguarding the same. In addition, e-money funds received in the form of payment by a payment instrument only have to be safeguarded when they are credited to the institution’s payment account or are otherwise made available to the HIRETT or credit union, subject to maximum delay of five business days after the date on which the e-money has been issued (Article 7 of the 2nd EMD and Article 4 of the PSD). This relates to e-money paid for by a payment instrument such as a credit or debit card. This statutory allowance for some reconciliation issues between e-money liabilities and safeguarded funds illustrates why in practice there is recognition for the need for an HIRETT to do regular working reconciliations that are subsequently fully reconciled when all transaction, processing, payments and settlement information is available for the day in question. However, unless there is a statutory allowance for reconciliation delay then, in addition to the e-money liability which arises upon funds transfer, the HIRETT also ensures that it has safeguarded funds based on a worst-case scenario of its likely e-money liabilities at any given point (given the reconciliation information known to it) and based on its objective to ensure the safeguarded funds are indeed adequate.

2.5 Protecting Funds held with a Credit Institution

The credit institution account must not be used for holding any other funds, and no-one other than the HIRETT/credit union may have an interest in or right over the funds in it (except an insolvency administrator under certain specified conditions and subject to limitations). This precludes a creditor of an HIRETT or a financier or counterparty (such as the card schemes, e.g. MasterCard or Visa) from having a charge over e-money holder funds. Given the requirement not to co-mingle or create a charge or interest under English law, HIRETT’s must therefore ensure they use a range of funding accounts for their business so as to keep separate e-money liabilities from other funding requirements that are required to offer the e-money services (e.g. pre-funding of amounts to cover funds in flight settlement collateral requirements from the card schemes).

3 REMITTANCE SYSTEM

E-currency remittance system is the most important part of the E-wallet project. This system controls how the company control the funds and how money movement inside the accounts are performed and total amount of all issued e-money. E-money are issued when they are purchased during the transaction process through the payment card.

E-money remittance and accounting model

The core of each e-wallet is its e-money remittance system that serves for following purposes:

1. E-money issuing system;

2. E-money redeem system;

3. E-money identification;

4. E-money accounting.

Example of e-money remittance

| Issued | |

| Issued total amount of e-money in GBP: | £10,000,000.00 |

| Issued total amount of e-money in EUR: | €8,000,000.00 |

| Issued total amount of e-money in USD: | $5,000,000.00 |

| Total issued amount in GBP: | £20,778,104.20 |

| Redeemed | |

| Redeemed total amount of e-money in GBP: | £4,000,000.00 |

| Redeemed total amount of e-money in EUR: | €3,000,000.00 |

| Redeemed total amount of e-money in USD: | $2,000,000.00 |

| Total redeemed amount in GBP: | £8,133,772,49 |

E-money issuing and redeem process:

Each company client can redeem his/her money from the e-wallet account upon request where HIRETT would buy its e-money, convert to chosen currency and settle to its bank account or payment card. This procedure is fully automatically operating and each client could make online statement where he sees received amount, redeemed amount and all other important information.

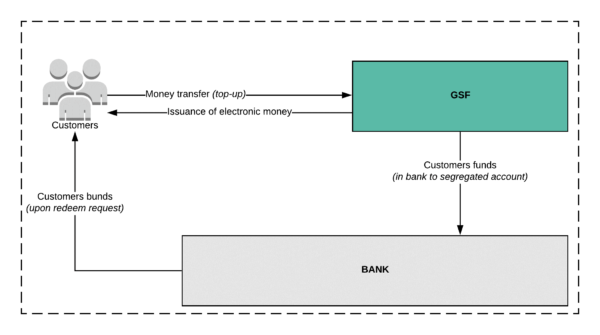

E-money scheme:

This scheme is showing the detailed money flow from payment process and up to the settlement process of the e-wallet system.

4 E-COMMERCE FUNDS SAFEGUARDING

Funds control rules based on legal entity as a client. The bank is issuing MID (Merchant ID) per 1 currency or multi-currency. For example:

- MID 1: GBP

- MID 2: EUR

In case of multi-currency:

- MID: GBP-EUR

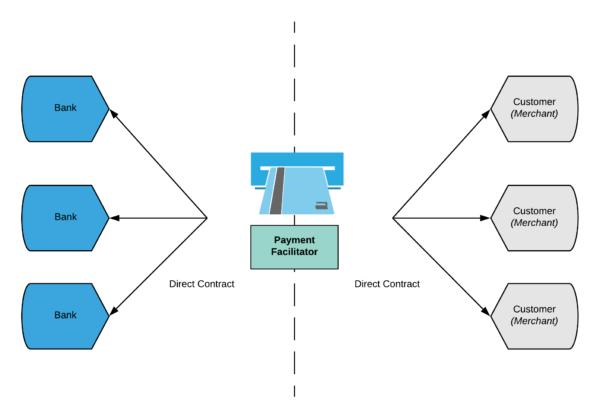

When the e-money is issued they are also separated in sub-accounts by currency. This e-money sub-accounts have account in real currency stored fully separated from other company funds and separately in each incoming currency. HIRETT would operate as SDWO (Staged Digital Wallet Operator) in a card scheme and also work as the payment facilitator.

Payment Facilitator model by the card schemes:

Bank accounts for funds control in real currency and in e-money:

- for merchant money in GBP

- for merchant money in EUR

- for merchant security deposit in GBP

- for merchant security deposit in EUR

Each bank would register the company as TPP (Third Party Provider) to comply with VISA and MasterCard regulations. Each single time there are either 2 party agreements. One, general between acquiring bank and another with merchant. Or there might be 3 party agreements if merchant is above 1 000 000 USD annual turnover based on VISA and MasterCard rules and by the card schemes acquirer is obliged to go into agreement with the merchant. The funds each time go directly to HIRETT for further merchant settlement.

HIRETT is E-Wallet, which is offering e-commerce merchants online services for accepting electronic payments by payment cards and other methods available in the gateway. HIRETT uses single payment gateway for their merchants and is responsible for receiving, consolidating, formatting and posting all transaction data from merchants to Acquirer bank’s) for presentation to international card organisations (ICO) at designated frequency. Company is responsible for settlement with merchants in accordance with HIRETT required settlement calendar.

Company defined following pre-requisites for merchant servicing:

| Settlement currencies | Transaction currencies | Funding currencies |

| GBP | GBP | GBP |

| EUR | EUR | EUR |

| USD | USD | USD |

Rules for Transaction and Funding currencies interdependency for Merchants. It can choose a funding currency. Transaction currency = Merchant funding currency, defined in Merchant Profile.

- transaction in GBP should be settled in GBP

- transactions in EUR should be settled in EUR

- transactions in USD should be settled in USD

Each of these currencies are stored in segregated accounts in a bank specially opened for clients processing funds.

5 CLIENTS FUNDS MANAGEMENT

Funds received from customers are transfered into a segregated bank account on the day, when the respective funds were received. In some situations, same day or even next day payment of funds into the segregated bank account is operationally impossible, particularly if a have some specific funding rules. There may be delays, but all funds which GFS collects are eventually stored securely by a bank.

Accounting records

HIRETT maintains accounting records which enable at any time and without delay to determine how much is owed to each customer (e.g. the principal amount of customer transfers) and how much belongs to the business (e.g. your working capital, fees, etc).

The accounting records for segregated bank accounts that are maintained include a report for each segregated bank account and a ledger account for each customer.

Systems and controls

Hirett has systems and controls in place that enable the complete and accurate recording of customer transactions and minimise the risk of loss arising through fraud, negligence or poor administration.

The systems and controls that company put in place in relation to the accounting of customers funds include the following:

- employing accountants with experience of money transfer businesses and customer funds accounting;

- ensuring that those involved in accounting are separate from those involved in receiving and paying funds;

- performing regular reconciliations of customer funds;

- having reconciliations reviewed and approved by senior staff;

- retaining reconciliations on file;

- having your customer money systems and procedures subject to external audit; and

- providing regular reports of customer funds to the executive board of HIRETT.

Reconciliations

The purpose of accounting reconciliations is to act as a control over safeguarded funds and to determine whether the amounts held within the segregated bank accounts agree with the HIRETT’s independent record of customer funds. Safeguarding provides that in the event of the insolvency of the firm, the funds within the safeguarding accounts can be allocated to the customers who have given the funds, so that the liquidator can distribute them accordingly. It is therefore necessary to ensure that reconciliations are performed to ensure that customer funds are properly accounted for and subject to the protection that safeguarding provides.

Two reconciliations are required. Firstly, a reconciliation of the amount due to customers as per the total of the customer ledger balances, with internal records of the segregated bank account. Secondly, a reconciliation between the internal records of the balance on the segregated bank account and a statement provided by your bank.

The FCA’s approach document in respect of the Payment Services Regulations states that the reconciliations should be carried out as often as is necessary and as soon as possible after the reconciliation date.

Reconciliations would be performed for each segregated bank account that the business has. If a shortfall in customer funds is identified on reconciliation, company would identify the reason for the discrepancy and introduce funds to eliminate the shortfall as soon as possible.

If a surplus is identified company would identify the reason and remove funds to eliminate the surplus as soon as possible.

If a discrepancy cannot be resolved, company would assume that the record showing the greater amount of customer funds is correct.

In determining how frequently reconciliations need to be performed, the following is considered:

- the nature of the business. Money transfer businesses are characterised by a high volume of transactions.

- the business model of the remittance business. It is likely that the business will charge fees for its services. These fees are mixed with the funds received for remittance and paid into the safeguarded segregated bank account. Regular reconciliations is required to validate the fees transferred out to your working capital account.

- the legal requirement imposed by the PSRs to have systems and controls in place that minimise risk of loss through fraud, negligence or poor administration.

- the size of the business. The greater the volume of remittances, the greater the need for robust systems of control.

Given the above, company would be performing client account reconciliations at least weekly if not daily. Where relevant funds are segregated in a currency different to that of receipt, without the instructions of the payer, the remittance would ensure that the amount held in the foreign currency is adjusted for exchange rate movements in order to meet the liability to the payer.

The Board of Directors would be provided with regular updates in relation to customer funds. The required information should include:

- the month end customer balances held;

- the proportion of customer balances held with each bank;

- details of new segregated bank accounts opened;

- unallocated cash balances; and

- the number of times a reconciliation has been performed and reviewed and details of the errors found on review.