FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

TERMS AND ABBREVIATIONS USED

- Compliance laws, rules and standards – HIRETT operations governing laws and other legal acts, HIRETT operations related standards defined by self-regulating institutions, professional conduct standards and codes of ethics and other standards of best practice related with HIRETT activities.

2. HIRETT – HIRETT Limited. HIRETT rates – the HIRETT Risk committee approved services price list that is valid at the day the respective operation is carried out.

3. HIRETT IS – a set of HIRETT data processing equipment and software

4. E-shop – a customer’s – on-line merchant’s site on the Internet, where the Customer offers its goods or services.

5. Account Manager – Sales department employee, who is authorised by HIRETT to carry out activities defined in the Procedure.

6. AML/RD– HIRETT AML and Risk Department.

7. Customer – on-line merchant, businessman with whom HIRETT concludes or is willing to conclude an agreement on servicing Payment cards on the Internet.

8. Agreement – an agreement that is concluded (or to be concluded) between HIRETT and Internet merchant on servicing of Payment cards on the Internet.

9. Payment card – payment instrument allowing to pay for goods, services and withdraw cash using special machines (ATM), POS terminals or to make payments on the Internet.

10. Payment card user – a private person on whose name the Payment card is issued to.

11. Monitoring software – a monitoring software, for example, G2 Web Services, Web Shield etc.

12. Current account – a settlement account opened for a Customer in HIRETT in line with the HIRETT

13. Procedure – HIRETT Merchant’s on-boarding procedure

14. International payment organizations – international payment cards organizations VISA International, MasterCard International and others, each or any of these.

1 MERCHANTS ONBOARDING PROCESS DESCRIPTION

HIRETT is cooperating with the merchants coming directly to the HIRETT. The first step for e-merchant is a face-to-face meeting with the HIRETT’s representatives.

HIRETT organising face-to-face meeting with the merchant within first three months after the business relationship was started, in case if such meeting was not occur.

The aim of the first meeting is to get the idea of a business and company presented, to get business plans and to get acquainted with the private persons, performing the business activity.

Merchant’s representative needs to fulfil the Customer application (Annex 2) and e-shop application (Annex 3).

Based on the gathered data, Account manager starts information verification.

The following checks are divided into three main areas:

- company check;

- private persons check (representatives and owners);

- Business and e-shop/site check.

2 COMPANYES & ITS REPRESENTATIVES AND OWNERS DUE DILIGENCE PROCESS

Company check consists from the following steps:

- VMAS/MATCH/G2/WEBSHIELD mandatory checks.

- Company registration documents;

- Company and its beneficial owners check against ‘’blacklists”/sanction lists/”rip-off”/ reports, credit bureau/ Better business bureau reports;

- Financial and account statements analysis;

- Possible adverse media findings in the web.

HIRETT is using any available open and trusted registers; like World check databases and other public resources.

- legal and business address check

Due to company’s legal address may differ from the business address, HIRETT is using Google maps to identify the physical address, if the on-site visit could not be organised in near future.

3 COMPANYS REPRESENTATIVES CHECK

In order to make sure that presented individuals are really engaged in the business activities, HIRETT is requesting:

- CV (curriculum vitae);

- Identification documents check;

- check against ‘’blacklists”/sanction lists /”rip-off”/ reports, credit bureau/ Better business bureau reports;

- recommendation letters

- account statements for last three months;

- utility bills

- information in a social networks (LinkedIn, Facebook and others)

- Possible adverse media findings in the web.

All this help to make sure that declared information meets the actual data.

Business and e-shop/site check

- URL (site) check

- Mandatory G2/WEBSHIELD Report check for every site;

- The site compliance with the Card organizations rules:

- merchant’s contact data;

- terms & conditions,

- privacy policy etc.;

- HTTP secure connection;

- Appropriate descriptor.

- “Whois” information check:

- IP address,

- registrar

- domain owner,

- history

- Traffic analysis and SEO analysis

- Presence in black/spam/scam lists and/or in any complaints board/rip-off reports

Based on information, gathered from e-shop application, provided by the Merchant, Account manager needs to complete the Merchant’s site check list (Annex 7) during merchants site check.

About all inconsistencies in information, Account manager need to inform Head of the Sales department for further decision.

4 MERCHANTS BUSINESS LEGALITY CHECK

HIRETT carefully scrutinizes the products and services provided by the merchants. The main issue is to gather the information about legislation and requirements not only for the merchant jurisdiction country, but for the all countries, where merchant’s trading activities are taking place in. But merchant can’t be activated until the conclusion of its business legality is done.

HIRETT staff needs to do all its best to prevent possible violations of import/export license requirements, and for additional could request:

- Legal opinion.

In case of necessity, where it is unclear that requirements are missing for web environment, HIRETT could ask to submit the legal opinion of the business from the independent reputable law company.

- License, term of validity, registration.

Information about possible licenses and/or additional registrations may be required for the specific business. In case one is needed HIRETT Account Manager needs to request the appropriate license and or registration improvement and checks its authenticity and term of validity.

- Main partners check.

HIRETT could request the agreements/contracts/invoices with the main Merchant’s partners and other documents, confirming business.

The reputation of the partners is checked the same way as the merchants.

- Evidences of reality of products traded on the site

HIRETT pays high attention to the transportation documents/bills of lading in order to prove the reality of the products performed on the sites.

In additional, HIRETT could request from the Merchant the documents/information like tracking numbers, confirming the product delivery to the final buyer. These documents could be checked selectively.

5 INTELLECTUAL PROPERTY RIGHTS, BRAND NAME OWNERS RIGHTS PROTECTION

Along with the documents requesting from the merchant, it is necessary to check the traded products to prevent possible violence of Intellectual property rights (IPR).

Thus, these products (including music, software, movies etc.) need to be checked in different trademarks/ patent registers:

- Trademark Electronic Search System (US Patent and Trademark Office)

- Espacenet patent search

- Findownersearch

- The Office for Harmonization in the Internal Market (OHIM) for EU and others.

As IPR violations occur not only for products (like replica products), but also in music, movies, software areas, HIRETT is following DMCA (Digital millennium copyright act) and EUCD (European Union Copyright directive) requirements.

If the merchant is engaged in any activities related to the financial sector, HIRETT does the full due diligence in order to verify merchant’s compliance with the supervisory/regulatory bodies requirements, like FSA or the Office of fair Trading in UK, FINRA (Financial Industry Regulatory Authority), NASD (‘National Association of Securities Dealers), SEC (U.S. Securities and Exchange Commission) in USA, and others depending on the merchants’ jurisdiction.

It is important to protect consumer’s financial losses and to verify that the merchant is under additional control of the appropriate regulatory body.

HIRETT enters into business relationship only with the merchants, which are not engaged (so far as the HIRETT is able to prove and verify) in any prohibited/controlled substances trading, branded products trading without appropriate license/agreement from the brand name owner and are not engaged in any other illegal activity or legal activity, but without appropriate registration, and which are not mentioned in any negative way.

During verification process, described in section 2 of the Procedure, in any stage of verification, Merchant could be declined in case of negative/inappropriate information discovered.

6 MERCHANTS ACCEPTANCE

After all required checks and verifications were taken merchant’s data should be entered into HIRETT Customer relationship Management system/registry:

- Merchant’s name;

- MID (Merchant Identification number)

- MCC (Merchant category code)

- URL (Merchant’s site address)

- Risk level

- Contact information;

- Contract person;

- Checks result (WEBSHIELD ;G2; VMAS; MATCH);

- Deposit amount and %;

- Collateral % and reservation time.

Calculation of guarantee deposit, collateral and merchant’s risk level assignment must be processed in accordance with HIRETT Merchants cooperation procedure and AML Policies and Procedures.

7 EDUCATION AND INFORMATION OF THE MERCHANT

To prevent possible fraud, threats and violations of legislation and requirements of International Card Organisations, reduce potential fraud and to increase knowledge of e-commerce rules, Account Manager needs to provide Merchant with Educational Material, useful links and HIRETT Limited Merchants Handbook and keep informing Merchant in case of any changes and/or updates.

ANNEX 1

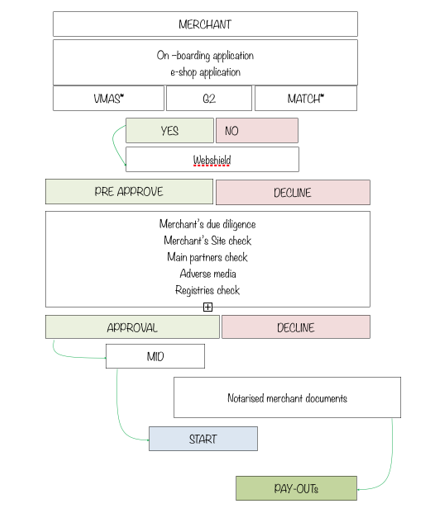

Merchants’ on-boarding scheme:

ANNEX 2

List of documents, which are needed from Merchant

For initial verification/check

- Certificate of incorporation

- Article of Association

- Memorandum of Association

- Power of Attorney

- Shareholder register and/or Declaration of Trust | Nominee service agreement

- Copy of passports

- Beneficiaries and other due diligence documents upon request

- Processing history

- Banking details

- Business related documents

- Other documents upon request

Notarised documents for pay-outs.

- Agreement and application forms

- Certificate of incorporation

- Article of Association

- Memorandum of Association

- Extract from register about shareholders no later than 15 days and/or

- Declaration of Trust | Nominee service agreement

- Copy of passports

- Signature validation

- Other documents upon request

ANNEX 3

Basic list of public registers/sours of checks

Specific lists:

ANNEX 4

Merchant’s site check list (to be added to customer’s file)

Instructions

The following checklist must be worked through and complete before your request for a merchant account can be submitted for evaluation.

- Evidence – Each item will be checked by a member of the Hirett staff.

- Passwords – If the evidence exists behind a password protected page then Merchant needs to supply a password to allow Hirett staff access.

- Site Under Development – If Merchant’s site is still under development and an item has yet to be added to the site any information in a word or similar document needs to be supplied by the Merchant.

- Item Not Applicable – There may be things within the checklist that do not apply to Merchant’s business. In this case will be filled with N/A with an explanation as to why.

Checklist

| Item | Requirement | Explanation & What is Needed | Evidence |

| 1 | The website does not redirect. | The website supplied on the application must be the website that will be used.

A redirected website is one where on landing on the website the visitor is bounced another website. This is not allowed. Such website URL must be vetted. |

|

| 2 | Information on Customer support is easily identifiable on the website | Customers must be able to find information on how the Merchant will support them before, during, and after they purchase from it. | |

| 3 | Customer Service Telephone Number | Customers must be able to find Merchant’s Customer service telephone number easily. Best practice is to have this number listed on as many pages as possible. | |

| 4 | Customer Service e-mail address is listed on the website. | Customer service e-mail address must be listed on Merchant’s site and easily identifiable.

Best practice is to have this on as many pages as possible. |

|

| 5 | Website Branding is as expecting | If merchant application is for a website selling shoes for example and the branding indicates it is selling furniture then it is misleading.

The branding of the website must fit with type of merchant account being applied for |

|

| 6 | European Corporate Address | The registered address and support/trading address must be listed on the website, usually the ‘Contact Us’ page.

The address must be within an EU Country. |

|

| 7 | The Card Holder is diverted to a secure site (HTTPS://) for the purchase process. | The information that Merchant is requesting from the Customers as part of the purchase process is considered sensitive and must be collected under an encrypted page. | |

| 8 | The website displays the VISA/MasterCard or other Card organisations logos. | Card scheme rules state that at any location, including websites, where a Customer can purchase using one of the card schemes that their logo is displayed.

Logos can be obtained online from the card schemes. |

|

| 9 | The Card Holder is asked for address and telephone numbers, both landline and mobile as part of the purchase process. | Collecting this type of information is important for fraud detection and prevention.

As such it is mandatory. |

|

| 10 | The website displays prices in full. | Customers must be shown pricing in a full and complete manner to avoid any confusion as to what they will actually be paying to complete the transaction. | |

| 11 | The transaction currency does appear on the website and/or during the checkout process. | Since some currencies have the same symbol on the site must be displayed the correct the correct ISO 4217 currency code.

An example would be : £30.99 GBP |

|

| 12 | Terms & Conditions are visible on the site. | The Customer must be able to read the terms and conditions for their purchase.

Best practice is to have them linked to from the main page as well as part of the checkout process |

|

| 13 | It is stated on the website when the card holder will be debited. | Customers must be told when their card will be debited. For goods that ship immediately the card can be billed immediately. If there is going to be a delay in sending or delivering the item then the card should not be debited until the item is ready to ship. | |

| 14 | There is a privacy policy available on the website | A privacy policy is one which describes how Customer details entered as part of the purchase process will be stored and accessed. Details of acceptable privacy policies are available online. | |

| 15 | The procedure for how a customer can return goods and/or cancel service must be available on the website | Customer must be able to easily find the procedure to opt out of the purchase and return goods and services.

Best practice is having this available in as many places as possible. |

|

| 16 | The shipping policy & shipping costs | How much customers will pay for shipping must be readily available on the website.

Best practice is to have it linked from the main page as well as part of the checkout process. |

|

| 17 | The delivery time-frame is stated on the website | How long shipping will take must be readily available on the website.

Best practice is to have it linked from the main page as well as part of the checkout process. |

|

| 18 | The refund policy must be readily available on the website. | Customer must easily be able to find the policy and process for obtaining a refund.

Best practice is to have this linked from the main page as well as part terms and conditions. |

|

| 19 | The descriptor must appear on the website. | The descriptor is what appears on the merchant statement.

The descriptor must be something the customer will associate with the purchase they completed when viewing their statement when it arrives. Best practice is having it listed in merchant’s terms and conditions, as part of the checkout process and on the receipt the Customer receives. An example would be: “This purchase will appear on your statement as Jim’s Shoe Store. |

|

| 20 | The Card Holder’s responsibilities regarding jurisdiction laws are stated on the website. | This point should be readily available on the website. | |

| 21 | All links on the website work | The website must be in a functioning state. |

ANNEX 5

Useful links:

http://www.mastercard.com/us/merchant/pdf/TB_CB_Manual.pdf

https://chargebacks911.com/

www.visa.com