FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

1 REQUIREMENTS FOR BOOKKEEPING PROCESS

HIRETT is E-Wallet, which is offering e-commerce merchants online services for accepting electronic payments by payment cards and other methods available in the gateway.

HIRETT uses single payment gateway for their merchants and is responsible for receiving, consolidating, formatting and posting all transaction data from merchants to Acquirer bank(s) for presentation to international card organisations (ICO) at designated frequency.

HIRETT is responsible for settlement with merchants in accordance with HIRETT required settlement calendar.

HIRETT defined following pre-requisites for merchant servicing:

Settlement currencies with Acquiring bank:

- GBP

- EUR

- USD

Merchant Transaction currencies:

- GBP

- EUR

- USD

Merchant Funding currencies

- GBP

- EUR

- USD

Rules for Transaction and Funding currencies interdependency for Merchants the Merchant can choose a funding currency between EUR or USD. Transaction currency = Merchant funding currency, defined in Merchant Profile.

- transaction in GBP should be settled in GBP

- transactions in EUR should be settled in EUR

- transactions in USD should be settled in USD

2 GUARANTEES

From the perspective of an Acquirer bank, each merchant transaction represents a measure of financial risk, for example chargebacks, re-presentments and ICO penalties can result in losses for the Acquirer bank. In order to insulate themselves from such losses, Acquirer bank may require a deposit or reserve on HIRETT merchant account related to monthly processing volume.

The funds in the reserve belong to the HIRETT, but are inaccessible for the period of time during which they are held in reserve.

HIRETT reserves following type of guarantee measures with Acquiring bank:

- deposit

- hold of payouts

- rolling reserve.

3 SETTLEMENT CONDITIONS WITH ACQUIRNG BANK

For settlement purposes under the agreement with Acquirer bank, the HIRETT receives funds from Acquirer bank from ICOs on behalf of the Merchant.

Financial transactions included in this process are:

- Presentments,

- Chargebacks

- Reversals,

- Re-presentments

Other payments included in this process are:

- Merchant service charges,

- Penalties

- The Merchant Implementation fees

- Dispute Resolution Fees

- Fees for other Services

4 SETTLEMENT CONDITIONS WITH MERCHANT

Minimum Threshold for Funds Transfer

HIRETT has established criteria for small-value payments to manage the Merchant settlement costs. HIRETT will use the following criteria to determine if a payment meets the threshold minimums:

- The payment is a minimum of 500 GBP equivalent for net settlement to or from Merchant;

- HIRETT will retain the funds transfer for 10 business days if the cumulative net settlement amount remains less than the threshold minimum.

Merchant settlement accounting schema

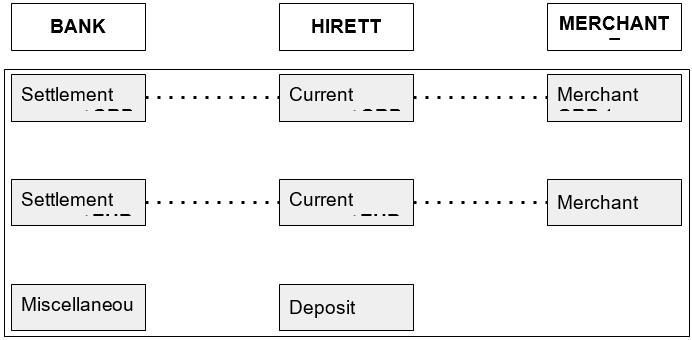

Merchant settlement accounting schema includes accounts used for HIRETT internal settlement reconciliation and accounting of expenses and losses, which occurs to HIRETT in e-commerce acquiring process for Merchants.

- Merchant settlement accounts (GBP, EUR, USD) – debited for Merchant funding payments credited for chargeback and re-presentment payments

- Account for Income from Merchants

- Deposit account

Generally HIRETT makes a credit payment to the Merchant. In separate cases HIRETT may debit Merchant to cover following payment events:

- Refunds

- Chargebacks

- Penalties

- Bank fees and commissions

In this case payment to the Merchant may also be with a negative balance. Merchant payment with negative balance handling conditions are described in Chapter “Settlement conditions with Merchant.”

General accounting schema

Merchant service charges

In a payment card transaction, the Acquirer bank deducts the Merchant service charges from the amount it receives from the ICO.

In a payment card transaction, the E-Wallet deducts the Merchant service charges from the amount it receives from the Acquirer bank.

Acquirer bank can charge HIRETT for various miscellaneous events:

- The Merchant Implementation Fees

- Clearing and Settlement Fees

- Dispute Resolution Fees

- Fees for other Services

Acquirer bank provides the data for HIRETT to allow settlement with Merchants to be carried out.

HIRETT must maintain sufficient funds in designated account – deposit or rolling reserve.

5 DISPUTE PROCESSING

The Disputes processing for VISA and MC:

| Acquirer | Card issuer |

| First Presentment | Retrieval request

First Chargeback |

| Second Presentment (for MC cards)

Representment (for VISA cards) |

VISA Pre-arbitration

MasterCard Second Chargeback |

| MasterCard Arbitration case filling (*) | VISA Arbitration case filling (*) |

The Acquirer and HIRETT receive money for First presentment. The difference between Arbitration case initiation for VISA and MasterCard is because of money flow:

- MasterCard does no credit Acquirer bank after Second Chargeback;

- VISA credits Acquirer bank after Pre-arbitration case .

Dispute management in Merchant level is HIRETT responsibility. HIRETT debits Merchant. If Merchant account currency <> Dispute currency, HIRETT converts amount using Acquiring bank commercial currency exchange rate.

The Acquirer bank pays to HIRETT daily payment-card activity’s net balance for all Merchants that is, gross sales minus chargebacks, reversals, refunds and applicable Acquirer bank fees and penalties. If Chargeback amount is less than Merchant payment account, Acquirer bank credits HIRETT amount. If Chargeback amount exceeds Merchant payment account, Acquirer bank asks HIRETT to return s Merchant amount.

6 MERCHANT FUNDING PROCESS

Merchant tariffs

For each Merchant individual tariff per each currency accepted by Merchant are assigned. Merchant settlement information:

- Settlement account IBAN of Merchant current account

- Transaction processing fees, including basic fees calculation algorithm per transaction

- Dispute items processing fees

- Value date

Merchant deposit

Initial deposit

When cooperation is started, the HIRETT and the Merchant agree on:

- Initial security coverage from planned monthly turnover.

- Deposit replenishment rules:

1. Monthly deposit management

2. Rolling reserve

Rolling reserve

A rolling reserve holds between xx-xx% of total approved Merchant processed transactions. It is held in escrow for six-twelve months by HIRETT and then refunded to the account of the Merchant.

Rolling reserve is calculated by following rules:

- Calculation day of month

- Percentage from turnover (in percent’s)

- Constant amount

- Turnover period

- Reservation period (in days)

At day “Calculation day of month” (in case of less days in month then value in parameter, then at last month day) system performs “rolling reserve” calculation,

Calculation is performed in several steps by HIRETT:

- calculating payments based on Merchant turnover for period

- calculating percentage from turnover

- rolling reserve” = “Constant amount” + “percentage”

- create money suspension on amount “rolling reserve” till end of “Reservation period”

Rolling reserve calculation algorithm can depends on:

- Merchant MCC

- Merchant monthly turnover and

- Acquirer and Merchant cooperation time

7 MERCHANT FUNDING

HIRETT pays the Merchant for its daily payment-card activity’s net balance that is, gross sales minus chargebacks, reversals, refunds and applicable fees and penalties. Bank settles with Merchant in business days only. Information about Merchant debt in HIRETT system should be stored in following way:

Information from HIRETT:

Merchant payment cycle

Planned settlement cycle with Merchants – x days.

Currency conversion

HIRETT offers Merchants the freedom to select differing transaction and merchant funding currency from GBP, EUR and USD.

HIRETT converts the transaction amount into Merchants settlement currency if Merchant transaction and settlement currency differs.

Merchant penalty processing

If HIRETT is penalized by Acquirer bank, HIRETT at any time and at its discretion passes through to Merchant actual amount of the penalty.

If net amount of payment minus penalties for Merchant regular payment covers penalty amount, HIRETT deducts penalty from regular payment.

If regular payment of Merchant does not cover penalty amount, HIRETT charges penalty against the Merchant deposit. Merchant should replenish the security deposit to a level deemed appropriate by HIRETT:

- The same level as before penalty was processed

- Increased security deposit

If Merchant security deposit does not cover penalty amount:

- issues bill to Merchant for any expense that exceeds what HIRETT was able to deduct from Merchant deposit