FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

1 Introduction

Document Location

This document (Regulatory Business Plan) and other related documents can be found under policies and procedures on the company servers.

Introduction

This document describes Hirett Ltd Regulatory Business Plan and accountabilities.

Document Purpose and Scope

To define accountabilities for the people, teams, or process that will be responsible in company business development.

Required Documentation

The conformance of actual procedures and practices to the documentation provided will be periodically checked by the Mr. Roman Davids, director, Hirett Ltd and Mrs. James, director, Hirett Ltd. Any changes to this document must go through the same process as described above.

2 Links and references

Associated Process Documents

The following documents are referenced or should be read in conjunction with this document:

| Document | Item | Location |

| Organizational structure | ||

| Opening and Closing Balance Sheets | ||

| Monthly Profit and Loss Statements | ||

| Monthly Cash Flow Forecast | ||

| Resumes and credentials of management |

3 Company Background

Hirett Ltd (hereafter referred to as “HIRETT“) is incorporated in England and Wales and wishes to apply to the Financial Conduct Authority (FCA) to operate as an Authorised Electronic Money Institution (AEMI) under the E-money Regulations 2011. Hirett Ltd is a privately-owned company under company number: 11102212.

Hirett Ltd is a classic financial company that was established in 2021. It is newly established company managed by experienced team from financial sector. Company’s management has more than 12 years of experience in financial industry, during last two years successfully managing the alternative investment fund management company established in Latvia under which manage several sub-funds with the value of the business more than 70 million euros.

Company has taken strategical decision to establish United Kingdom financial institution for their already existing clients to offer unique opportunities to make money remittance services and offer other financial products that could raise competition with the banks and offer better quality products and service level.

Company board has background in company management and development, financial consulting, accounting and legal services. All this comprehensive knowledge base gives an opportunity to offer high quality solutions to the customers. United Kingdom with its capital London give unique image to build a financial company for existing clients and infrastructure.

The purpose of the business plan is to help the company to outline and meet objectives as a successful Authorized Electronic Money Institution. Company aim to clearly display the vision and development for the future of the FinTech industry and classic finance. The business plan will clearly define the market, services and potential growth within the sector over the coming years.

Company has analysed both internal United Kingdom market and EU and EEA zone for business development. If to take into consideration the significant growth of the FinTech industry in the last couple of years we can see that classic banking services are going into the second plan showing the development of the modern financial companies with more flexible approach and new products which give added value to the customers.

The business plan sets out core strategic objectives for the future and direction of the company for the next 3 years and making calculations based on market research specially bought for this purpose.

As per regulation 13(5), company head office is based in United Kingdom, London. The head office physical address is [ ].

Company business model is based on the classic banking services with modern IT technologies and customer requirements for the fast and efficient payments. The AEMI license would allow to consolidate client’s funds on a company accounts, control risks regarding the fraud or any other violations by providing the opportunity to settle the funds the client by his own request. The business model would be more based on a corporate customer from European Union and mostly from United Kingdom. Company would also open an account for natural persons but as addition to the primary business. Corporate customers would allow to generate significant part of the income if to take into consideration that the company have already a potential client base of more than 70 million euros that after the authorization would offer to become United Kingdom company clients.

Product Functionality:

- Business account opening

- Private account opening

- Placement of funds

- Verification of funds

- P2P payments

- P2B payments

- Withdrawal

- Non-cash transfers

- Recurring payments

- Currency exchange services (from GBP to EUR as an example)

- Internal payments

- External payments using SWIFT/SEPA

- Corporate and private payment cards

- E-commerce services for the business clients

Such services would allow to offer banking level products with lower cost and more technical features. Especially for corporate clients who are looking for new opportunities to develop their business and receive professional financial services.

The company is targeting mostly middle size and large business to make more personalized service level and to offer individual approach.

The company has set-up general strategy to make banking level services in the field of FinTech industry for a classic retails business in United Kingdom and European Union. The head office of Hirett Ltd is located in London, United Kingdom.

Management of the company meet all conditions of Regulation 13(4B) as they have been involved in financial business since 2005 working with European banks and financial sector. Executives are able to demonstrate extensive knowledge and experience of managing large companies and payment business.

Company Chief Executive Officer has a wide experience in business management and got several important nominations of his managed business in European Union as “The Innovation of the Year”, “The Investment of the Year”, “The Largest Tax Payer”. All this experience would be invested into new business development in United Kingdom to support financial industry, develop new innovative products and build a strong and unique team of high level professionals.

The Hirett Ltd or HIRETT (abbreviation) would be a new example of new approach to classic finance with highly professional management team and personalized approach to each customer.

Company’s revenue sources:

- Electronic payment services commission

Company’s expenses overview:

- Economic

- Administrative

- Marketing

- Sales

- Education and training

- Legal and advisory costs

- Monitoring costs (FCA)

- IT infrastructure and associated costs

- Banking costs (payments and infrastructure)

- Write-off of losses (fraud)

4 Money Laundering Regulations

Money laundering is generally defined as engaging in acts designed to conceal or disguise the true origins of criminally derived proceeds so that the proceeds appear to have derived from legitimate origins or constitute legitimate assets.

HIRETT complies with all money laundering regulations and is registered in HMRC for:

- Money Laundering Regulations

- Proceeds of Crime Act

- Bureau De Change

- Money Remittance

Company has developed internal polices to comply with money laundering regulations and prevent any attempts to for illegal activity. HIRETT is using rules and procedures like AML policy, Risk policy, IT systems that prevent such cases and monitor customer behaviour and transactions.

HIRETT will have constant monitoring of illegal activity by cooperating fully with authorities and reporting all suspicious activity to National Crime Agency (NCA).

The main goal of HIRETT anti-money laundering procedures is to minimize all possible risks in order to prohibit and actively prevent money laundering and any activity that facilitates money laundering or the funding of terrorist or criminal activities by complying with all applicable requirements under Bank Secrecy Act (BSA)/Anti-Money Laundering (USA), Directive (EU) of the European Parliament and of the Council and Visa and MasterCard regulation regarding Money laundering prevention.

HIRETT policy has a strong risk-mitigation approach (fraud prevention tools and customized risk rules) which helps guarantee compliance with all existing AML stipulations. All employees of HIRETT are obliged to receive AML training on commencement of their duties. Staff will be given a copy of this procedures with guidelines and education materials and will be tested on its contents before starting any client facing duties.

AML policies, will be reviewed and updated on a regular basis to ensure appropriate policies, procedures and internal controls are in place to account for both changes in regulations and changes in the business.

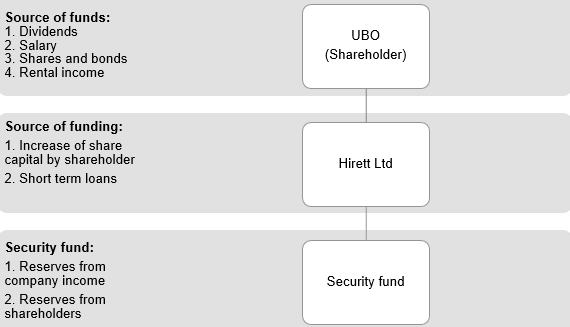

Funding structure:

The following structure shows the details procedure of HIRETT funding structure and how the company is planning to make reserves for unexpected situations to hold company stability.

6 Location of Business and Passporting

INCLUDING ANY INTANTION TO PASSPORT

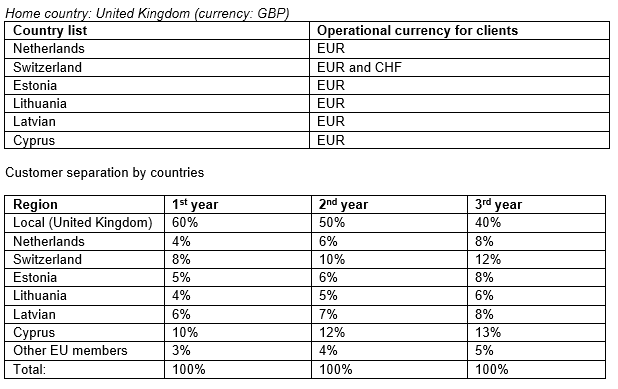

HIRETT will establish its presence in the United Kingdom where the majority of its clients will be located. London is worldwide known as the capital of the FinTech business, due to this company is planning actively develop internal market and make a strong competition to European Union member states. The strategy of building the analogue to classic banking in a digital form would help to achieve main goals to find the customers remotely in all European Union member states.

Target markets outside the country of presence could be seen below:

Service passport

HIRETT would apply for full passportization to all European Union member countries and EEA members. The EEA states are: Austria, Belgium, Bulgaria, Croatia, Cyprus (Republic of), Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Non-EEA states

Separately company would like to ask for the right to apply for the special passporting Switzerland and Gibraltar for the purposes of providing cross border services and services clients from these jurisdictions.

Company is not planning in the nearest future to work with the agents, distributors or establish any kind of branches in the European Union zone.

7 Target Markets

HIRETT is the company mostly oriented for the business clients of middle and large size. Mostly this are European companies working in industrial industry, information technologies, sales.

To analyse target markets, we are using the British company PaymentsCM LLP report called Payment Cards & Mobile research (Payment Cards Yearbook 2016-2021). Payments Cards & Mobile is an established and award-winning hub for global payments news, research and consulting. They work with recognised industry experts to provide impartial, up-to-date and relevant information and analysis on every area of payments.

This report mostly was used to calculate the possible exposure of company’s business to different European Union countries. Such marketing analytics allows to see the potential growth and evaluate each country separately case-by-case and to develop individual approach to each market separately.

HIRETT mostly is targeting the countries, where the e-commerce market is highly developed due to the economical and geographical factors, or with potential growth of the market.

In the European Union United Kingdom is well known country for business and the FinTech (Financial Technologies) companies, because of that the home country of HIRETT would be the target market to start the business and launch all business processes. HIRETT target client is the middle size business whose monthly turnover is not less than 50,000.00 GBP or EUR in equivalent. The high-level client for HIRETT starts with monthly turnover of 500,000.00 GBP or EUR in equivalent. Company management is highly experienced executives from the financial and business industry that have all required skills and abilities to onboard such level of customers.

Despite of the business clients company would also provide service to the regular customer who would be mostly the management or employees of the business customers. This would allow to offer the full service without losing clients by non-sufficient service level or products portfolio.

List of target markets in European Union:

- United Kingdom

- Netherlands

- Switzerland

- Estonia

- Lithuania

- Latvia

- Cyprus

Due to this, analysing target markets company has taken additional parameter like number of cardholders in particular country to understand possible amount of transaction and their purchasing opportunities over all European Union.

HIRETT will start working with European B2B market and mostly oriented in English speaking countries. This would give opportunity to use existing infrastructure and team to develop the business without investing additional money into multilingual support. Based on analysed data we have also received valuable information about amount of electronic payments done by EU citizen annually that give us overall view on our market size with diversification by countries.

Since the focus is on obtaining a reasonable number of large clients, rather than thousands of smaller clients, the marketing strategy is very much targeted towards each industry and the appropriate senior decision makers.

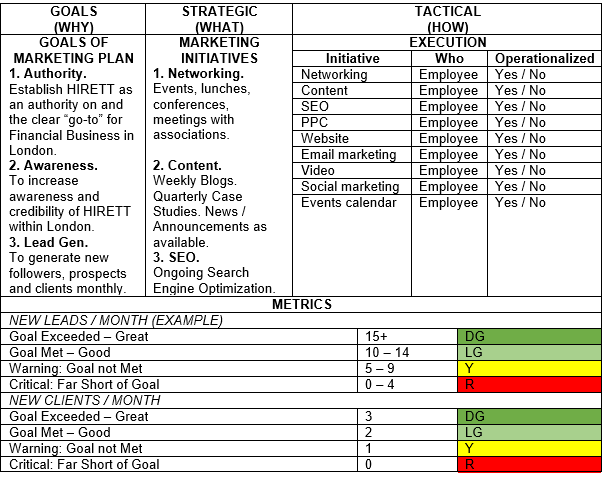

8 Marketing Plan

Marketing plan is developed for the same period as the business plan, which means 3 years and contains different sales channels and methods to promote company products and brand name. HIRETT is the business oriented company that is offering banking level services with the full financial product portfolio.

Marketing plan identifies following business points:

- Who are company customers

- How company will reach them

- How company will retain its customers so they repeatedly from it

Properly done marketing plan will be the roadmap that company would follow to get unlimited customers and dramatically improve the success of the organization.

Capital initial requirement is set as 350,000.00 euro with ongoing capital requirements 2% from an average outstanding e-money, or the same amount whichever is greater, as per the Method D calculation contained within the Electronic Money Regulations (EMR).

The initial funding will be using the company’s assets, and be deposited into an account under the control of HIRETT, prior to Authorization. Subsequent funding will also be met by HIRETT shareholders.

In case of critical situations, company has following plan of funding:

- UBO(s) would be able to increase companies share capital from own resources

- UBO(s) personal loans to the company to solve the critical situation (short term or long-term loans)

- Investments from UBO(s) owned companies on the short term or long-term basis

- Company would also make internal deposits from the income that would be stored on the separate account for unexpected situations

- Profit from selling company products to its customers

Company goals can (and should) be refined each quarter. The company has defined the “stoplights” metrics that define what it would consider bad, good and great. Below is the description of table from above:

- Dark Green (DG): “Excellent” – Exceeded your goal by a healthy margin.

- Light Green (LG): “Good” – your goal, or ideal number of new leads.

- Yellow (Y): “Warning” – short of your goal, attention required.

- Red (R): “Critical” – far short of your goal, serious attention required.

Components of Marketing Plan:

- Lead generation.

- Search Engine Optimization (SEO).

- Awareness

- Lead generation

- Networking

- Content

- Search Engine Optimization (SEO)

These are all the tangible components of HIRETT marketing plan.

The following marketing campaigns would be used to promote HIRETT services in the listed countries:

- Events

- SEO

- Cold calling

- Email marketing

- Content marketing

- Social media marketing

To track company marketing plan performance company would use special CRM tools available on the market to see the results and to update performance plan for the marketing and sales teams.

Customer attraction plan 2021-2021:

| Year/month | User amount (minimum goal) | User amount (target) |

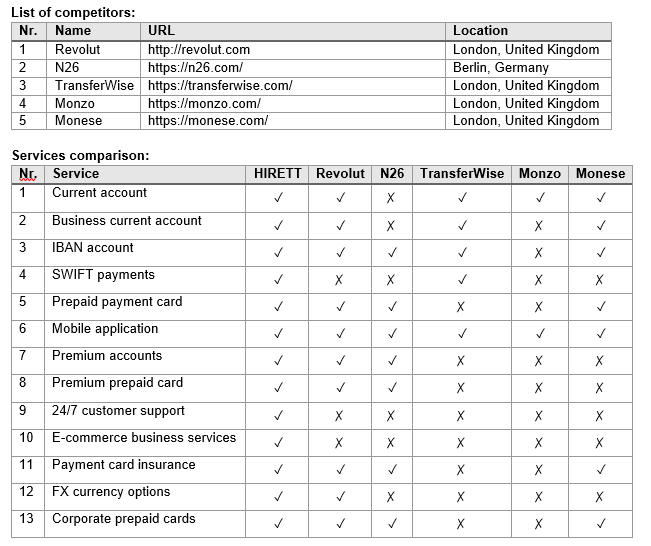

9 Competitor Analysis

The business strategy is based on the concept that banking services could be provided not obligatory by credit institutions but also FinTech companies can offer competitive solutions.

The fundamental aspect behind the business model is to create a successful e-money institution whose revenue is directly linked to the results delivered to clients.

During the competitor’s analysis, the company has taken 5 most significant European payment industry market players and made it details analysis.

Factors that were taken into consideration for choosing the competitors:

- Brand awareness.

- Public image of the company.

- Target industries where competitors are working.

- Customer and language support.

- Technical platform development.

- Offered services.

- Team and management.

- History of the company.

- Country of incorporation.

- Local legislation.

- Target markets size.

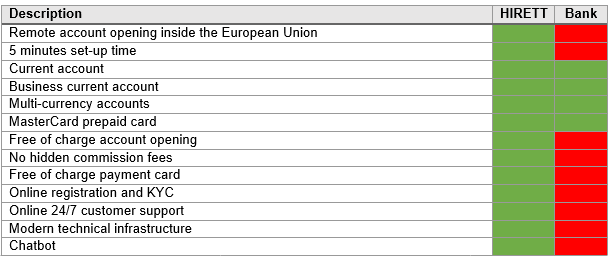

The table above describes the 5 most important FinTech companies in the European Union that were trending during the 2021. All of this companies provide similar services to HIRETT and most of them are from United Kingdom. Company evaluate this as a good opportunity as if there are so many successful business examples that show only the market potential.

Most of the companies are more customer oriented and services are presented mostly to regular customers and traveling with international money transfers. HIRETT is planning to make more business products for European Union registered companies with United Kingdom current account and European IBAN that would allow them to work without any borders and make cross-European business.

Corporate internet banking is still not evaluated correctly and this niche is empty. The only competition is from the classic banking but with their policies it became extremely difficult to open an account for the start-ups or non-UK legal entities.

HIRETT want to change this situation and offer full solution to business, its management and employees. If the company is registered in European Union it can apply for account in 5 minutes and if information from EBR or Company House is available on a company account would be opened within the minutes. All KYC and AML check would be performed automatically using modern due-diligence tools.

HIRETT is planning to become business hub that would go independently on the market in comparison with competitors listed in the table developing its own model and products portfolio.

From all competitors, the most interesting solution is offered by TransferWise were each business customer receive domestic UK, USA and IBAN accounts. These is really a huge step for an international business development for European clients.

Customer service is another important thing that was analysed during the competitors analysis as most of the companies offer account opening during the business day that makes it hard for a lot of small and middle size businesses who want to spend the day by making money and in the evening or night cover administrative tasks.

10 Competitive Advantage

HIRETT is a multi-currency wallet with a payment card for business and simple users. It allows people to feel the difference between classic banking and modern “banking style” e-wallet systems that completely duplicate the banks functionality but are more flexible, efficient, fast and client friendly. Company client do not need to visit any kind of physical office to open an account, all that is required is computer and internet connection.

The main advantages between the bank and HIRETT wallet are:

Online banking competitive description:

HIRETT focus on modern design, personalisation, low fees and snappy customer service to tempt people in. The company also feature real-time payment notifications, meaning that customer receive an alert every time there is some activity on its account.

This not only make it easier to keep track of the spending, but customers can also immediately spot if someone’s using its account fraudulently.

HIRETT offers a contactless prepaid MasterCard linked to its current account. Customers may load money via a debit card, bank transfer or through external payment systems like Apple Pay for example. HIRETT is planning to launch the mobile app which categorises customer spending into an easy-to-read graph, and includes logos of the retailers they have spent money with. When the customer spend money, the app sends an instant notification, as payments clear much faster compared to traditional banks.

The future development will lie in customer willingness to share spending data with businesses that HIRETT have partnered with to receive deals based on customer spending patterns and behaviour.

Business clients from United Kingdom or European Union receive a unique opportunity to open a business current account within the minutes and work internationally to do the business without extra fees or complicated onboarding process.

11 Product

HIRETT product is e-wallet (or as the company describe the product “mobile bank”) based on B2B business model that allows to accept payments from multiple channels and route the money by themselves. The company would promote two product lines:

| Regular customers | Business Customers |

| Current account | Business current account |

| Prepaid card | Business prepaid card |

| Premium accounts | E-commerce merchant accounts |

| Premium subscription | Business premium accounts |

E-wallet is based on the concept of security, stability and simplicity. Current regulations together with the classic banking approach opened the new potential to the FinTech industry that lead to the new companies’ arrival to the market that are making serious competition to the classic banks.

11.2 Product registration and activation cycle example

- At the Registration page (website or mobile website or mobile application) User enters his/her phone number, captcha and checks User Agreement checkbox;

- A unique password is generated and delivered via SMS or another channel to the User;

- User enters his/her phone number or email and password to log in to User’s account, which includes information about User’s profile, balance, and balance history;

- To gain additional functionality, the provides his/her personal data and pass due-diligence procedure;

- User’s status is upgraded and additional functionality without limitations is enabled.

11.3 Card Issuance

Payment card issuance is divided into two steps: batch preparation and card details assignment.

Batch preparation is the initial request from the Issuer to Host Provider to generate a batch of card details. The card details are delivered to the Issuer in a text form and are stored in the web application database used for storage of user data. Each set of card details is then assigned to a User on-request basis.

To generate a request, the User must fill in a request form with his name and address and must have sufficient funds on his balance to cover the card generation fee.

Example card issuance:

- User ensures that the balance has sufficient funds to cover card generation fee;

- At the Card order page (website or mobile website or mobile application) User enters his/her personal data;

- User confirms payment for the order;

- For virtual card user receives card details via SMS. Sample message format: “Your HyperCard details: Number – 1234 1234 1234 1234; CVV2 – 1234; Expiration date – 01/2012. Please store your HyperCard card details in a secure place;

- For plastic card user receives his payment card via royal mail or courier services. The PIN is generated inside his account by the system.

11.4 Placement of funds

HIRETT funding channels are divided only into online. Online channels employ placement of funds by electronic means alone and include banks and payment systems such.

Online channels:

To use an online channel, the User must have an account opened with the bank or the payment system with which he can authorize payments to Issuer’s respective account with that bank or that payment system.

Example fund placement with payment card:

- User selects his/her payment card system;

- Issuer issues a request via payment form;

- Payment system process order for the customer based on the request;

- User is redirected to the payment form and enters his card credentials and confirms the payment. Payment of the request is executed.

- Payment system notifies the HIRETT on the payment of the request.

- HIRETT verifies payment data to match with profile data.

- Funds are credited to User’s balance.

11.5 Merchant accounts

HIRETT is offering a merchant account for payment card acceptance in the internet. There is no offline payments, only e-commerce services. To open a merchant account company must be from one of European Union customers and have documents available in the Company House or European Business Register. Merchant account registration, activation and integration is available only in online form.

Merchant processing limits and withdrawal together with rolling reserve and security deposit is calculated based on the risk level of merchant and other important factors like:

- Time of company registration

- Country of registration

- Business type based on the MCC code

- Processing volumes

- Transaction history if available

- Chargeback volume

- Fraud volume

- Pricing policy

- Business model

HIRETT products are based on a strong focus on data and transparency. HIRETT wallet offers a full current account, allowing customer to set up direct debits and standing orders. Customers get instant notification to their phone or email when they spend, and there are no fees for overseas spending or cash withdrawals. Business account have full customer service that is categorized based on monthly turnover. For the customers with high volumes HIRETT will provide individual approach with special remote managers that are analogues to private bankers.

HIRETT product line is mostly oriented in a service level and time for account opening. 2021-year e-wallet project still do not have 24/7 customer support and account opening. Customers still need to find a time to open an account even remotely during the business day that is usually from 9:00 AM and till 18:00 PM from Monday to Friday. Company goal is to make this process constant without any time frames, customers should have an opportunity to manage their finance and preferred time and any location. Especially when a business is going more and more online, companies are mostly becoming virtual with its owners who are traveling all around the world and doing business remotely. For these customers are developed HIRETT wallet that allow to open a business or regular current account 24/7/365.

Financial management have the same AML and risk policies, but in more efficient and transparent way. HIRETT is planning to have deep integration with United Kingdom company house and European Business Register (EBR) to open business current accounts within the minutes using official publicly available information and full online due-diligence form. The most important task for the company is to offer full banking level service that include:

- SWIFT and IBAN payments

- SEPA payments

Company would also offer premium product line that would have:

- Premium accounts with 5 minutes customer support response time

- Premium prepaid cards

- Special luxury product design

- Individual pricing for products like e-commerce with if speak about business customers

12 Promotion

HIRETT is planning to promote its products through social media and international events. The most important resource for the products promotion would be following advertising channels:

- Facebook Advertising.

- Google Advertising.

- Instagram Advertising.

- Twitter Advertising.

- LinkedIn Advertising.

- Industry trade shows.

- Private events for premium customers.

International FinTech events

HIRETT is planning actively to participate in international events to promote its services and products to the industry and business customers. The events calendar would be set-up for company management and sales team for the full year and approved by the board.

Below is an example of events calendar:

EXAMPLE

| Nr. | Event name | Time | Team | Place | Expanses |

| 1 | MasterCard Europe | 2021/07 | 3 | Berlin | £5,000.00 |

| 2 | Merchant Payment Ecosystem | 2021/08 | 5 | Berlin | £4,600.00 |

| 3 | VISA Europe | 2021/09 | 2 | London | £2,500.00 |

| 4 | London E-commerce Show | 2021/10 | 4 | London | £3,500.00 |

| 5 | E-com21 Baltics | 2021/11 | 3 | Riga | £5,500.00 |

| Total number of events: | 17 | ||||

| Total expenses: | £21,100.00 | ||||

13 Price

Consumer acquisition strategy of HIRETT is based on active sales strategy and pricing policy oriented on particular segments. Revenues for the company will be obtained through customers divided on regular and business. These revenues will be secured from consumers activity inside the system.

Regular customer pricing plans

Regular customer pricing plans

| FREE | Premium |

| Free UK current account | Free UK current account |

| Free Euro IBAN account | Free Euro IBAN account |

| Internetbank FX rates | Internetbank FX rates |

| Free bank transfers in 25 currencies | Free bank transfers in 25 currencies |

| 5 Free ATM withdrawals per month | 5 Free ATM withdrawals per month |

| Free unlimited FX volumes | |

| Free exclusive Premium cards | |

| Free overseas medical insurance | |

| Free global express delivery | |

| Exclusive priority 24/7 customer support | |

| Exclusive Premium promotions | |

| FREE of charge | £7,85 monthly / £94.20 annually |

Business customer pricing plans

| STARTING | CLASSIC | PREMIUM |

| < £50,000.00 incoming funds | < £500,000.00 incoming funds | > £500,000.00 incoming funds |

| Internetbank FX rates | Internetbank FX rates | Internetbank FX rates |

| Hold, receive and send money | Hold, receive and send money | Hold, receive and send money |

| Free instant internal transfers | Free instant internal transfers | Free instant internal transfers |

| Corporate cards | Corporate cards | Corporate cards |

| Priority support | Priority support | Priority support |

| Personal online manager | ||

| £35.00 monthly / £420.00 annually | £50.00 monthly / £600.00 annually | £75.00 monthly / £900.00 annually |

E-commerce pricing policy

| RETAIL | ADVANCED | PROFESSIONAL |

| < £50,000.00 transactions | < £500,000.00 transactions | > £500,000.00 transactions |

| Antifraud system | Antifraud system | Antifraud system |

| Chargeback protection | Chargeback protection | Chargeback protection |

| Priority support | Priority support | Priority support |

| VISA, MasterCard | VISA, MasterCard | VISA, MasterCard |

| Recurring billing | Recurring billing | Recurring billing |

| Tokens | Tokens | Tokens |

| 3D Secure | 3D Secure | 3D Secure |

| Online statements | Online statements | Online statements |

| SLA 99,99 | SLA 99,99 | SLA 99,99 |

| 90% conversion ratio | 90% conversion ratio | 90% conversion ratio |

| Premium support | ||

| PRICING | ||

| 1.5% per transaction | 2.5% per transaction | 3.5% per transaction |

| £0.50 refund | £0.50 refund | £0.50 refund |

| £35.00 chargeback fee | £40.00 chargeback fee | £45.00 chargeback fee |

Pricing policy depends from different factors such as:

- Customer turnover

- Region of work

- Business risk

- Reputation

- Transaction amount (for e-commerce)

Product fees would be reviewed annually based on the financial forecast and final results of the company. Another important factor is market on which company is operating, depending on a competition level in particular region price may differ to the end customers.

Generally, the pricing model is based on the following principles:

- Subscription fee (monthly and annually)

- Commission fee (% from each transaction for the e-commerce merchants)

In addition to this there might be added “supporting” fees such as:

- Chargeback processing fee

- Refund fee

- Card renewal fee (in case if it was lost)

- Monthly monitoring fee (for the e-commerce merchants)

- Onboarding fee (for the e-commerce merchants)

HIRETT pricing policy would be prepared by Financial Department, presented by company CEO and approved by the board.

14 Place

The place of service provision would be London, United Kingdom. Company would service customers remotely making all required KYC and due-diligence procedures. Each customer would be made aware via the terms and conditions agreement that the end wallet account is provided by HIRETT. Service would be provided on a clear basis and each user can always reach the customer support to get the immediate help.

Customers may apply for an account using following options:

- Sign up on company website using the special form

- Sign up using the mobile application for a regular account (would be developed)

For the end customer, the most important factor to use the services would be internet connection.

Company office is located in London, United Kingdom from where customers are serviced in all European Union countries using the English language. In the future based on the marketing and business plans company would add other significant European languages.

15 Types of E-Money and Payment Services

HIRETT business model is oriented on the middle and large size customers that are looking for reliable, stable and easy to use e-commerce solution. The business segment is B2B and B2C sectors where each customer passes due-diligence procedure before going into any relationships. Due-to business specific company customer could be only European Union entities.

Company is using the electronic money institution model to:

- Facilitate payments.

- Transfer money between accounts.

- Issue payment cards.

- Open current accounts.

- Open IBAN accounts.

- Make international SWIFT payments.

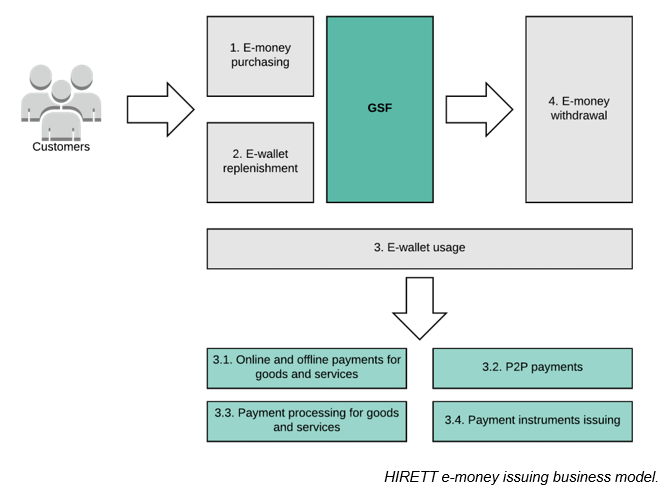

HIRETT could be considered as an electronic money storage service that is used to conduct online payments such as e-transactions and electronic bill payments (for example invoicing). Company technical platform is a modern analogue to classic internet bank. As the core is used e-money issuing platform that issue the particular amount of e-currency during each wallet top-up.

E-money basic scheme:

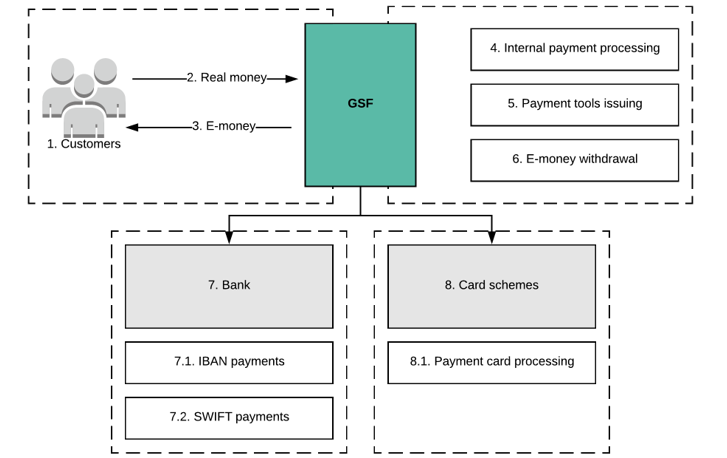

E-money advanced business scheme:

HIRETT business model description:

- Customers are both business or natural persons.

- For real money company is issuing e-money and top-up consumer account. Account could be loaded using one of following payment tools:

- Payment card.

- Current account top-up.

- IBAN transfer.

- SWIFT transfer.

- After account top-up e-money are loaded to consumer account inside the system.

- E-money can be used to make internal payments.

- HIRETT is issuing payment tools like prepaid cards that are based on e-money.

- E-money can be withdrawal to the customer bank account or payment card.

- The bank is used to process real money transactions like:

- IBAN payments.

- SWIFT payments.

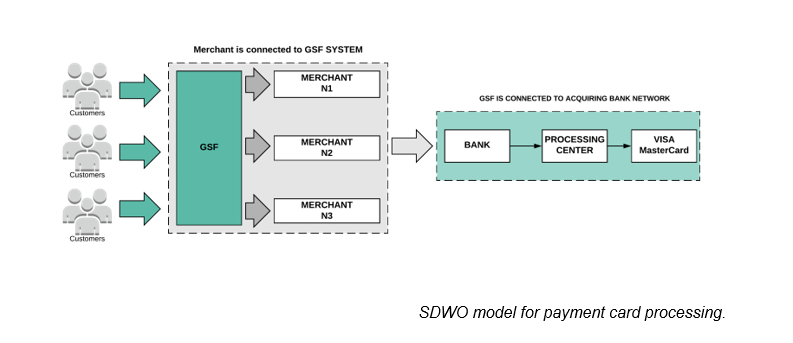

- Card schemes are used for e-commerce transactions using the SDWO (Staged Digital Wallet Operator):

- Payment card processing.

SDWO model (for e-commerce customers):

The SDWO e-money payment scheme:

- The first goes funding stage at HIRETT payment page.

- HIRETT record and stores payment card data.

- Wallet ID is passed to the merchant and saved as the transaction data.

- Payment is complete on the customer website.

- HIRETT is passing card data to the acquiring bank using an API integration.

- Acquiring bank using the processing centre process the transaction and send to VISA or MasterCard.

All this process is fully automatic and takes less than a second. The process flow shows each party and how it is connected to the global process.

16 Agent and Distributor Arrangements

HIRETT is not planning to have an agents or distributors at the initial stage of business. Company would evaluate this after the official launch and then if company would decide to work with agents or distributors it would inform FCA to receive an approval before getting in any business relationships.

17 Use of Branches

HIRETT is not planning to have any branches and would operate from the head office that is located in London, United Kingdom.

18 Auditing Arrangements

HIRETT intends to have an independent internal audit function reporting directly to the Board. Monitoring will be performed internally by the Compliance Officer via a consolidated Compliance Monitoring Plan.

19 Governance Arrangements

The UK Board will comprise two Executive Directors also covering the following roles:

- Mrs. Marina Johnson, Compliance Officer & Money Laundering Reporting Officer (MLRO).

- Mr. Roman Destro, Executive Director and Chief Executive Officer (CEO) and Chief Financial Officer (CFO).

Resumes and credentials of the above-named individuals are enclosed with this application.

A member of the Executive Team will chair Board Meetings and any general governance meetings of HIRETT. The Board will collectively be responsible for the strategy, direction and day to day management and running of all areas of HIRETT. A member of the Executive Team will be responsible for developing and delivering the business, apportioning responsibilities throughout the company and overseeing the establishment and maintenance of systems and controls. In addition, each member of the Executive Team will have individual responsibility to deliver on their assigned areas of responsibility and to oversee the establishment and maintenance of appropriate systems and controls for their respective functional and business areas.

The Board will meet on a regular basis, at least once a month, and more often as and when required. At Board meetings, the MLRO & Compliance Officer will report on HIRETT’s compliance with established Risk Management policies, procedures and operations and on any communications with the FCA including dissemination or SARs.

The standing agenda will include:

- Regulation and Compliance.

- Sales and Marketing.

- IT Development and Implementation.

- Risk Management including FCA reporting.

20 Risk Management

The Company agrees that it is everyone’s responsibility to identify potential risks and bring them to the attention of the Compliance Officer who is primarily responsible for leading the risk management process on a day to day basis. If a risk is identified, the Compliance Officer should be given as much information as possible and is responsible for categorising the risk. The Compliance Officer will be responsible for implementing a risk framework by maintaining a risk log which will provide a complete oversight of emerging and actual risks.

The Company has established a risk management system which provides timely risk identification, measurement, control, management and reporting. The main elements of risk management are:

- The Company’s risk appetite, which depends on the permissible level of risk which the company is prepared to take on. The Company has established “Customer risk assessment provisions” and “The list of allowed goods and services”, which provide guidelines for attracting and evaluating customers. These documents are revised and updated at least once per calendar year,

- The Company’s policies – the documents that cover minimum mandatory requirements for all the Company’s operations. Each policy has the owner, who is responsible of introduction of Policies requirements in Company,

- The Company’s risk profile. On a regular basis (at least annually) Company reviews the main risks the based on the Company profile, assessing each risk impact and risk changes and documenting new identified risks through all Company operations. Each major risks the risk management plan is drawn up, setting out the responsibilities, activities and deadlines,

- Stress scenario tests (critical case studies) – Company regularly assesses various high-risk events and their impact on the Company’s financial results and operation stability,

- The occurred risk events register in which Company records risk cases which occurred or almost occurred, their impact on Company Business and risk reduction measures,

- The Company has “Business Continuity Plan” document, which is tested and updated once per calendar year. The Company has established Crisis Response Team, which is responsible for activities in emergency situations,

- The Company has established the limits and other special conditions – either in staff job descriptions or in a separate document, which regulates Company’s business performance.

The Company’s main operational risks are:

- Operational risk (including reputational, legal and strategic risks).

- Liquidity risk.

- Compliance risk.

- Reputation risk.

- Country risk.

- Customer risk.

HIRETT have developed and put in place a number of policies, procedures and manual in order to implement internal controls, mitigate the key business risks and assure compliance with current regulations.

Management’s focus on maintaining high levels of control will remain as a priority and ensure that we operate in a safe and efficient manner at all times.

Company control mechanisms include:

- Anti-Money Laundering policy.

- New Customer take-on Procedure.

- KYC Policies.

- IT Policy.

- Data Protection Policy.

- Governance of our business.

- Financial Crime Prevention manual.

- BCP and Disaster Recovery.

- Framework Payment Terms and Conditions.

Although all of HIRETT’s staff will be responsible for identifying and raising risks, the Compliance Officer will maintain day-to-day coordination of this. Identified risks will be escalated for inclusion on HIRETT’ risk log.

The Compliance Officer is responsible for incorporating and maintaining this policy, and the day to day control of the Risk Management Log, ensuring it forms an effective part of HIRETT attitude to risk. The Board has ultimate responsibility for Risk Management within the company, and setting the risk appetite.

The risk log will include the following information for each identified item:

- A unique identifier.

- A risk category (settlement, operational, counterparty, liquidity, market, financial crime, foreign exchange, environmental, compliance/legal, financial, IT, product).

- A risk owner. Each risk will be assigned to the most appropriate person within the company to own the risk. Naturally, the actual monitoring and mitigation may be assigned to other members of staff, however the risk owner will have sufficient seniority and influence within the company to ensure that, where possible, the risk is mitigated in an acceptable manner and timeframe;

- A risk description.

- A probability and impact rating. Each identified risk will be given a probability score and an impact score (Low, Medium-Low, Medium-High or High) in accordance with risk values set by the Board. The Impact and Probability scores then need to be referred to the Overall Risk Score Table to determine the overall level of risk posed; and

- A description of mitigating factors to lessen or eliminate the risk.

A key piece of management information will be the Risk Management Log (hereinafter the “Log”). This will be used to record all identified risks and will form the basis for regular reviews at Board Meetings. Risk owners will be required to give an update on the progress towards mitigating the risk and to propose whether the risk should remain active.

A dated version of the Log will be saved immediately before each review in order that an archive exists showing the historical development of risks

If a risk actually occurs (the threat is realised), the Compliance Officer and the Board must address the risk and implement the steps outlined in the Risk Management Policy, as relevant. Once the risks are contained, the Compliance Officer will review the root cause for the event to see what lessons can be learnt and update the Log accordingly.

If it could have been possible to positively lessen the risk then systems and controls will be implemented to protect against the risk reoccurring.

If it could not have been possible to affect whether the risk occurred (for example, the introduction of new regulations) then systems and controls will be put in place to reduce the effect on the business the next time the risk occurs.