FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

EXECUTIVE SUMMARY

Hirett Digital Payments Ltd (“Hirett Digital Payments Ltd” as service) is a web-based payment services that allow buyer and sellers to transfer funds instantaneously while protecting against fraud and identity theft. Unlike credit card Hirett Digital Payments Ltd is an E-money

institution (EMI) allow any merchant to access funds and allow customer to pay for goods without disclosing sensitive banking or personal information.

Small web-based merchants are currently unable to sell their goods online due to their inability to process credit cards. Processing credit cards require a merchant to acquire a merchant account from their bank, something that is currently prohibitively expensive for small online merchants. At the same time, customers are currently hesitant to disclose their credit card number to merchant on the internet, due to the risk of fraud. As a result, many merchants are unable to capitalize on the World wide web to reach and sell to new customers.

The ecommerce industry has two problems: the cumbersome checkout process and the increase of cybercrime. More people are using mobile devices for online purchases and the current experience is not aligned with expectations for a fast and user- friendly checkout. The poor desktop experience of tedious form-filling is worse on a mobile device with checkout abandonment topping 90%. Additionally, 3 out of 5 shoppers have five or more online passwords and adding credentials is difficult to manage.

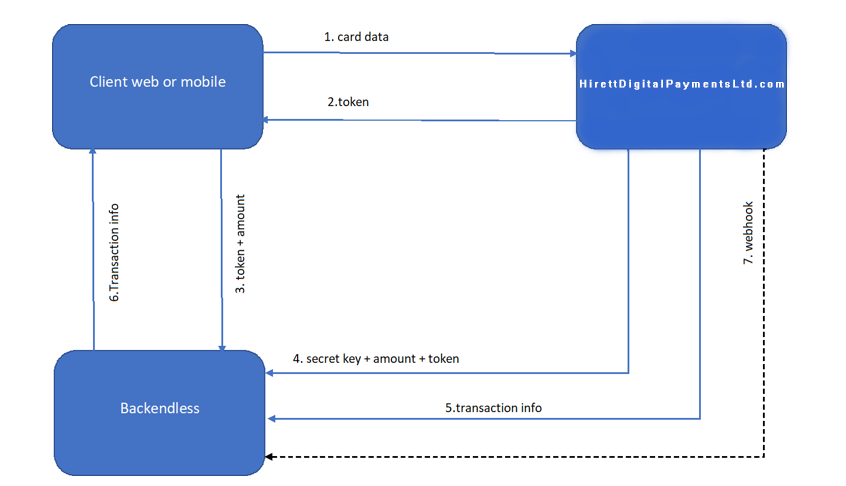

The Hirett Digital Payments Ltd’s mobile payment app solves both problems by offering retailers and consumers a simpler, faster and more private way to shop online. With Hirett Digital Payments Ltd, the typical transaction is completed in under 12 seconds, achieved through numeric PIN-based authentication and a streamlined user interface for selecting payment methods and shipping addresses. The long checkout process becomes the simple ‘swipe card, enter pin, hit OK’ experience everyone knows from in-store checkout. The Hirett Digital Payments Ltd has also devised an ingenious process where all financially sensitive information is encrypted and stored on the phone using peer to peer encryption. The Hirett Digital Payments Ltd reduces risk by encrypting the user’s sensitive information and storing it locally in the app on their mobile device, and accessible through world wide web. The encrypted information, passed securely to the payment gateway, is never shared with retailers, 3rd parties.

The Hirett Digital Payments Ltd’s fully functioning mobile app will be available for iOS and Android users. Ecommerce sales will reach £3.7 Trillion by 2021. In 2019, an estimated 310,000 eCommerce websites worldwide generated over £3.1M and Forrester estimates that alternative payments platforms will be adopted by 45% of shoppers by 2017 representing

£6.43B. The Online Payment Software Developers industry has grown tremendously the last five years. Revenues earned by developers has been growing at average of 17.6% annually, totalling

£21.7BN in 2017. The accelerated pace of revenue growth has led to high profit margins for the industry’s major players and lured a large amount of new entrants. During the past five years, the number of enterprises in the industry has grown to 1,459.

We will monetize software by licensing Hirett Digital Payments Ltd to online retailers. With a small, medium and large retailer-based solution, the Company will charge its accounts a flat fee based upon a price band that fits within these spectrums. Specifically, these are £150, £5,000 and

£15,000 per month, respectively. The product is completely free for consumers and retailers can incorporate their own payment processor thus avoiding additional processing fees. Retailers also benefit from partnering with Hirett Digital Payments Ltd by incurring a lower shopping cart abandonment rate, thus enabling retailers of all sizes to earn a direct return on their investment.

The Company anticipates that their primary customers will be online retailers that generate at least 40,000 orders a month or approximately £25M a year. According to Internet Retailer Top 500 and Second Top 500, there are at least 1,000 e-tailers that meet this profile. The Company will employ its own direct sales force to reach these potential accounts. The Company also holds strategic partnership with Bluefin Payment Systems and Digicert, who has agreed to promote Hirett Digital Payments Ltd to smaller retailers. The minimum monthly order size for these small accounts is at least 1,225 orders a month or £730K a year. It is unknown how many accounts meet this profile. Hirett Digital Payments Ltd will utilize mass marketing branding efforts to develop top-of-mind awareness for its services.

Hirett Digital Payments Ltd faces competition from other payment technologies. The most notable services are: Visa Checkout, Google Wallet, Paypal iZettle and Apple Pay. Despite a competitive field, such services are still in the early stages of adoption and the Company has a significant advantage over other technologies in the market due to its unparalleled ease of use and ability to pay without

usernames or passwords. This technology is protected by a pending patent and allows Hirett Digital Payments Ltd to break into the market with a service that sets itself apart from existing technologies.

Asad Raza Kazmi is the founder of Hirett Digital Payments Ltd, and is running Software application and cloud services business in UK for the last few years and he is leading a team of seasoned industry professionals who are well connected and attuned to the needs of the market. The work ethic and business acumen of this team will be the key drivers that propel this venture towards a position of lasting success.

SOURCE OF FUNDS

Funds have been arranged to facilitate the project from the sale of a commercial building owned by the Director and income from other businesses trading in UK.

OBJECTIVE

The purpose of this plan is to provide investors with the information necessary to evaluate the scope and future growth of Hirett Digital Payments Ltd in the marketplace. In addition to serving as a road map for management, the plan will show that:

- A significant market opportunity exists when analyzing the current market demands and competitive landscape;

- The management team in place is qualified to execute on a well-thought-out operational, marketing and sales strategy;

- And the correct capital structure will allow for a long lasting, profitable

DESCRIPTION OF BUSINESS

Hirett Digital Payments Ltd is a merchant payment processor and payment gateway all in one, in simple terms we offer customer to take credit card directly from their website or using our application. We do not charge monthly fees instead we charge only 2.45% + £ 0.20 penny transaction for which is standard and comparable to PayPal. The difference between HIRETT DIGITAL PAYMENTS LTD and PayPal is you can take credit card directly verses having your customer redirected to make payments, this is a turn-off for some prospective customers. Moreover, HIRETT DIGITAL PAYMENTS LTD can be integrated with almost all major e- commerce and m-commerce service provides.

STARTUP SUMMARY

The total start-up funding needed to successfully implement this venture is £2.25M.

| Startup Funding | Startup Requirements | |||

| Startup Expenses to Fund | £800,000 | Startup Expenses | ||

| Startup Assets to Fund | £1,450,000 | Legal | £100,000 | |

| Total Funding Required | £2,250,000 | Prelaunch Marketing | £120,000 | |

| Application Development | £368,000 | |||

| Assets | Website Development | £30,000 | ||

| Non-cash Assets from Startup | £0 | Consulting | £60,000 | |

| Cash Requirements from

Startup |

£1,450,000 | Rent Deposit | £2,500 | |

| Additional Cash Raised | £0 | Computer and Office Equipment | £60,000 | |

| Cash Balance on Starting

Date |

£1,450,000 | Other | £59,500 | |

| Total Assets | £2,900,000 | Total Startup Expenses | £800,000 | |

| Liabilities and Capital | Startu pAssets | |||

| Liabilities | Cash Required | £1,450,000 | ||

| Current Borrowing | £0 | Startup Inventory | £0 | |

| Long-term Liabilities | £0 | Other Current Assets | £0 | |

| Accounts Payable

(Outstanding Bills) |

£0 | Long-term Assets | £0 | |

| Other Current Liabilities

(interest-free) |

£0 | Total Assets | £1,450,000 | |

| Total Liabilities | £0 | |||

| Total Requirements | £2,250,000 | |||

| Capital | ||||

| Planned Investment | ||||

| Owner | £0 | |||

| Investor | £2,250,000 | |||

| Additional Investment

Requirement |

£0 | |||

| Total Planned Investment | £2,250,000 | |||

| Loss at Startup (Startup

Expenses) |

-£800,000 | |||

| Total Capital | £1,450,000 | |||

| Total Capital and

Liabilities |

£1,450,000 | |||

| Total Funding | £2,250,000 | |||

PRODUCT & SERVICES

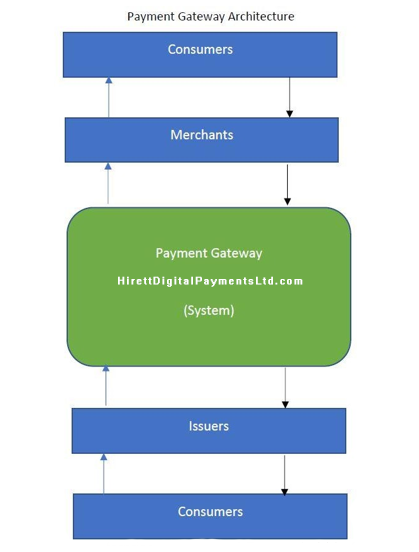

As a payment service business enterprise Hirett Digital Payments Ltd offers our merchants online services for accepting electronic payments by a variety of payment methods including credit card, bank-based payments such as direct debit, bank transfer, and real-time bank transfer based on online banking. Typically, they use a software as a service model (SaaS) and form a single payment gateway for their clients (merchants) to multiple payment methods.

As a payment service business enterprise Hirett Digital Payments Ltd offers our merchants online services for accepting electronic payments by a variety of payment methods including credit card, bank-based payments such as direct debit, bank transfer, and real-time bank transfer based on online banking. Typically, they use a software as a service model (SaaS) and form a single payment gateway for their clients (merchants) to multiple payment methods.

A payment service business enterprise can connect to multiple acquirers or issuing banks, card, and payment networks. In many cases, the service provider will fully manage these technical connections, relationships with the external network, and bank accounts. This makes the merchant less dependent on financial institutions and free from the task of establishing these connections directly, especially when operating internationally. Furthermore, by negotiating bulk deals they can often offer cheaper fees.

Furthermore, as a full-service payment service business enterprise we offer risk management services for card and bank-based payments, transaction payment matching, reporting and fraud protection in addition to multi-currency functionality and services.

SERVICES

As a payment gateway customers take card payments from a variety of sources: from your website, over the phone or mobile and even by email. By using HIRETT DIGITAL PAYMENTS LTD, one can offer its customers even more ways to do business – and that means customers have even more chances of making a sale.

With a Payment Gateway like us, you can be ready to accept card payments in 24 hours. It’s the fastest

way to start accepting card payments from customers.

One gateway. Three ways to pay.

Let’s take a closer look at the payment options a Payment Gateway opens for you.

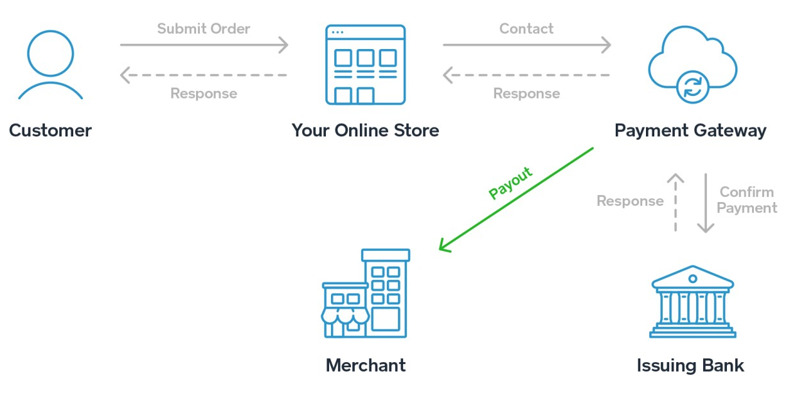

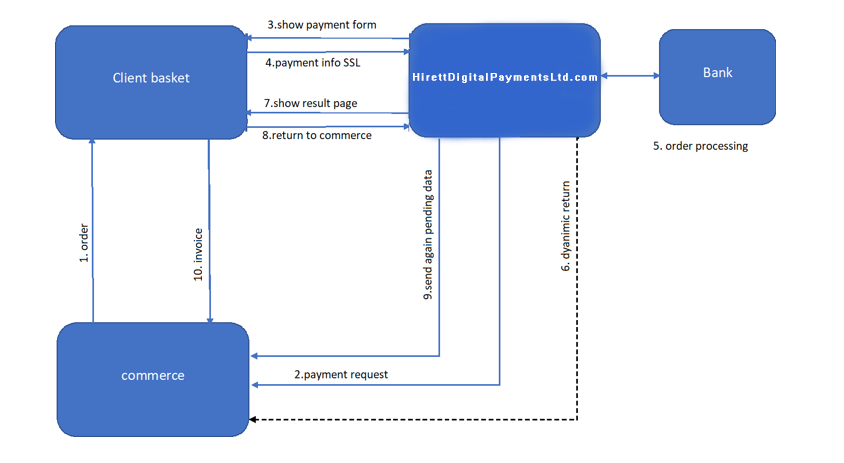

Operation Steps

- Cardholder enters Merchant web store and Clicks “Buy Now”.

- Merchant validates and deliverers details to the HIRETT DIGITAL PAYMENTS LTD

- HIRETT DIGITAL PAYMENTS LTD interface display the payment form to

- Client enter the card data on payment form and send to

- HIRETT DIGITAL PAYMENTS LTD uses the Bank system interface to process the request and Bank system returns to HIRETT DIGITAL PAYMENTS LTD a result of the processing

- HIRETT DIGITAL PAYMENTS LTD send an Instant Payment Notification return by HTTPS/GET Response by back- office process, this message contains the payment result

- HIRETT DIGITAL PAYMENTS LTD display a result page to

- Client do click on return to commerce

- Result page resend the payment result

- Commerce send an email to confirm the order payment

Website Integration

When added to a website, our Payment Gateway acts like an online card machine. It creates a secure page that connects its customer’s bank account with the Merchant Account, while wrapping the transaction in layers of encryption. Furthermore, we’ll provide ready-made code to ensure it simply plugs into any of over 40 leading ecommerce carts.

Phone/Mobile/Amazon Alexa/Google/Siri

Also known as a Virtual Terminal, phone-based or mobile including Alexa, Cortana Google and Siri etc payments are an essential back-up.

Shopping Cart Plug-in

This is the ultimate in discrete payment methods. It lets customer create and send payment links in seconds with our online portal. You can track the progress of your transaction and follow up late- paying customers with a click of a button.

MANAGEMENT

The Quality Assurance is maintained by company Quality Coordinator who works with external consultants to get direction to maintain the quality of services. The Senior Manager role looks into the day to day analytics and incident management of the gateway. Emphasis is clearly put on achieving financial targets, as these are recognized as crucial to high quality of services. This highly focused approach ensures that HIRETT DIGITAL PAYMENTS LTD maintains a competitive edge. Overarching responsibility remains with the Director.

Senior Management consists of Director/Shareholder and Technology Manager who performs duties of managing software development and integration team. HIRETT DIGITAL PAYMENTS LTD makes it easy for any developer to access and manage the capabilities of the financial system.

Our Partnerships team is responsible for the strategic technology and payment partnerships required to offer these capabilities globally. In particular, we are looking to establish a large and growing number of partners that enable us to successfully launch new markets and empower our users to expand their business internationally.

Support staff and contractor assist in the day to day activity of the business.

EXIT STRATEGY

After careful consideration, we have deployed the following scenario for the investor and management to recover their investments.

· Scenario ONE: REPAYMENT

HIRETT DIGITAL PAYMENTS LTD is a privately owned company. The company repays its investor in full.

· Scenario TWO: BUYOUT

HIRETT DIGITAL PAYMENTS LTD as a successful income generator operational expenses growth and see the opportunity to expand its brand into additional market. This means doors for additional product offerings and revenue streams.

Scenario THREE: MERGER

HIRETT DIGITAL PAYMENTS LTD merge with other companies to expand its market research and development capabilities.

· Scenario FOUR: IPO

The HIRETT DIGITAL PAYMENTS LTD sells its interest through the sale of stocks on the open market. Going public is an arduous and challenging journey for HIRETT DIGITAL PAYMENTS LTD but, if achieved, is highly rewarding.

MARKETING

Payment process system is speedily changing and extremely competitive. To meet this challenging situation, it’s a smart strategy to build a campaign to reach potential customer.

Our potential clients are wide target market ranging from consumer to SME and large enterprise – merchant ranging from upscale retailers to small restaurants from token systems, cash pooling to cashless transactions.

We will also try to capture the attention of potential partner VARs and ISVs that will include our solution in their end-to-end point of sale (POS) system.

To reach merchants, we will make the complex simple. Detail the services we offer beyond credit and debit card processing, such as

- Electronic credit/debit processing,

- Mobile payment support,

- Gift cards,

- Prepaid cards, and

- e-Commerce solutions.

Resellers and developers working in the POS or related industry are most interested in how a partnership will help them grow their businesses. Provide them information about our hardware and software partners so VARs can see how our payment solution could complement the end-to-end point of sale (POS) systems they design.

For ISVs, highlight information on the resources we have available that support the development of new integrations — such as online tools, testing environments, and a forum where developers can connect and discuss solution.

With our Impressive VARs and ISVs campaigning with our knowledge showcased on an up-to-date website and regularly posting blogs and adding new content. Potential partners will perceive our activity online as an indicator of how on top of things we are, and how responsive we will be when they need answers.

We will adopt inbound channel strategy for marketing for HIRETT DIGITAL PAYMENTS LTD that is because many of the strategies are very low cost while also delivering reliable results, especially when we combine them all together.

Email Marketing

We will professionally approach and adopt a way of communicating with prospects and customers, which is where email marketing can help. Emails don’t cost very much to send and there are many good email marketing software platforms out there like MailChimp, Mailtrain and Constant Contact, as well as more sophisticated solutions that integrate with CRMs like Act-On, Pardot, and Hubspot.

Social Media

Being active on social media may not seem like a high priority for a payments processing company, but it is necessary. Without an active social media presence, we will be noted for our lack of participation, which can hurt our brand and potentially lead to lost interest. Having a steady posting activity will not only boost our brand, it will also have positive effects on our SEO.

Blogging

We cannot overstate how important blogging is when it comes to an inbound marketing strategy. The impact of having new content posted on our website is well-documented and it gives customer post fodder for our social media accounts.

Website

Our website www.Hirett Digital Payments Ltd.com and www.Hirett Digital Payments Ltd.net most vital sales tool right from the start. The effort that we put to send emails, engage on social media and posting blogs is all going into an analytical website site that looks at the pattern of its customer and guide our way to convert potential leads into opportunities. We will google analytics to gather information on user interest behavior.

SEO

Search engine optimization is an ever-moving target. However, there are some basic components you should know and have on your website. Having the right SEO structure and SEO-rich content costs nothing to implement, but you have to do it correctly to get an organic search ranking boost. We have a team of expert web developers who will address the User experience element by collecting input from different sources and implementing correct SEO.

Existing Growth Levers

- Identifying a gap in the market between self-hosted payment processing options like Authorize.net and branded third-party processors like PayPal and Google

- Building a “developer-first” product that makes it easy for companies and developers to

accept payments immediately.

A powerful word-of-mouth growth engine fueled by developer advocacy and relationship growth.

Future growth & expansions opportunities:

- e-Wallet payment processing

- Global payments and international growth

- Payment processing integration for existing platforms

- NANO Satellite based authentication

MARKET ANALYSIS

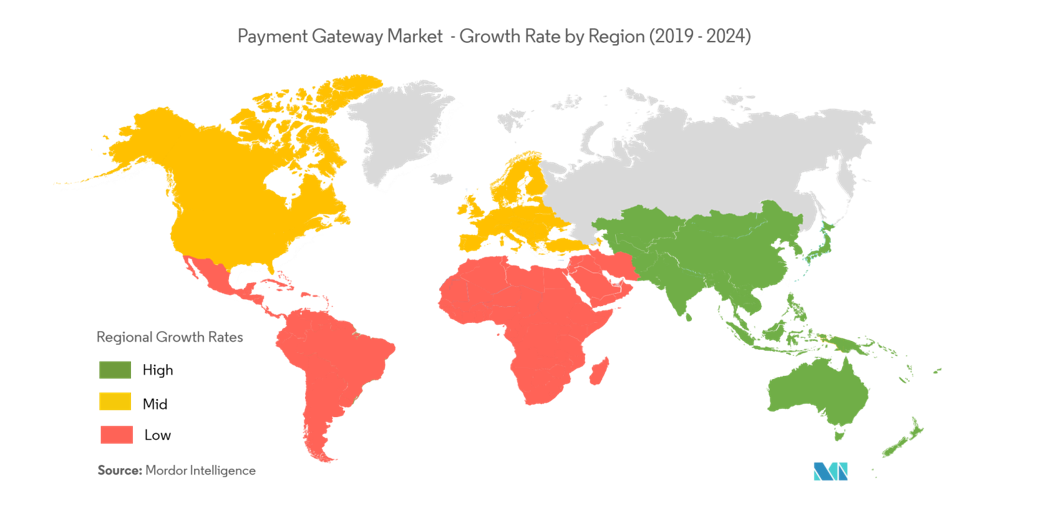

The Payment Gateway market was valued at USD 17.2 billion in 2019 and is expected to reach USD

42.9 billion by 2025, at a CAGR of 16.43% over the forecast period 2020 – 2025. The integration of payment gateway has become one of the most critical aspects of any businesses in every industry. It allows collecting money through the customer preferred bank without compromising on sensitive data.

- The internet penetration is increasing rapidly across the globe. According to ITU, 80% of the population from the developed countries have registered to access the internet in 2018. Whereas, from the developing countries only 45% population have shown the activities of accessing the internet. Cumulatively worldwide population has reached 51% for the same which is a consistent growth of over 8% year on Increasing internet penetration is driving the growth for a payment gateway market; especially in the developing countries.

- Additionally, with the increasing internet penetration and awareness about the ease of online transactions, consumers are changing their preferences for making payments online. The hurdle free transactions generate confidence among the users for switching to online transactions. This rapid adoption of the online method of payment is fueling the payment gateway market

- On the other side, stringent regulations in the payment industry and the rising cases of cyber attacks and data breaches are restricting the growth to an

Key Market Trends

Retail Segment to Grow Significantly

- The number of online transactions globally across businesses is increasing rapidly. It is stated in the world payment report 2018 that, non-cash transactions has reached 482.6 billion in 2016, which is 9.8% growth since 2012 and is expected to follow the growing trend in the forecast According to retail tech news, e-commerce retailing covers almost 12% of the total retail industry.

- The raging demand for online retailing across the world is expected to drive the online payment, thereby, propelling the payment gateway market over the forecast period. Furthermore, the retail companies are rigorously adding payment gateway(s) to their

standalone website to fuel the consumer’s order and build goodwill. For instance, BJ’s Wholesale Club, an American membership-only warehouse club, incorporated PayPal gateway for its online customers in the year 2018. This is likely to boost the market growth over the next recent years.

Asia-Pacific to Witness the Fastest Growth

- Asia-Pacific is exceptionally overshadowing other regions in terms of adoption of the online transaction. The smartphone penetration in India was 26% in 2018; and according to RBI, the mobile payment transaction volume increased by about USD 10 billion in the same year, owing to increasing internet penetration and smartphones in the

Also, China has expanded its mobile and online payment services through ascending the internet penetration in the rural areas of the country, which would not only encourage the customers to transact online but also boost the payment gateway, Alipay in particular, thereby, propelling the market growth.

SWOT ANALYSIS

Strength and weakness of HIRETT DIGITAL PAYMENTS LTD as well as the opportunities and threat that exist within the marketplace

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

COMPITETION

Nowadays, the companies are restructuring their businesses and revenue strategies by moving towards a digital approach. This is projected to spur the growth prospects of the payment gateways market in the coming years. Additionally, the increasing usage of mobile wallets, which provide a convenient way for users to make in-store payments, has emerged as another major driver. Besides, an increasing number of customers are using smartphones or tablets for making online reservations and payments, thereby stimulating the demand for payment gateways. Moreover, various banks are collaborating with retail vendors to provide cashback offers so as to attract new customers and retain the existing users.

Currently, the market is highly consolidated by players, such as PayPal and Stripe. However, other companies are trying to cope with the market share and performing merger and acquisition to acquire more consumers.

- PayPal Holdings,

- Amazon Pay (Amazon.com, )

- Stripe, Inc.

- Skrill Limited

- PayU Group

- Sage Pay

- World Pay

COMPETITIVE ADVANTAGES

What follows is a listing of the primary competitive advantages of the Company upon entering the market.

- Consumers do not require any new credentials to Just a one-time set up, their phone number and PIN

- Setup is completed in less than 60

- No new payment processor Merchants can use an existing one

- Minimal streamlined integration into eCommerce platforms

- Data is stored encrypted locally on the user’s device within the Hirett Digital Payments Ltd is immune from cyber breaches.

- Outstanding support and service for the product

- Knowledge and leadership of founders

BARRIERS TO ENTRY

The increasing competition and expected consolidation makes it challenging for new entrants in the industry to enter. New entrants must have a fundamental knowledge of website development, online financial transactions and securing sensitive information on the internet. This necessitates a workforce of highly skilled employees and an investment in an infrastructure to provide online payment services. Hirett Digital Payments Ltd’s unique model allows it to overcome these challenges by shifting the storage of sensitive information to local devices.

Furthermore, regardless of how secure a new entrant’s payment platform is, lesser-known companies may struggle to gain the trust of merchants and consumers. This barrier to entry reinforces itself: Firms cannot gain the trust of businesses and consumers without establishing a well-known brand name, and firms cannot establish a well-known brand name without attracting a large user base of consumers and merchant partners. Despite these challenges, the HIRETT DIGITAL PAYMENTS LTD management team is confident it can overcome such obstacles as Hirett Digital Payments Ltd differentiates itself with an unparalleled shopping experience. With its innovative mobile and web based, secure and easy payment system, it will quickly earn the trust of merchants and consumers alike and be able to defend its positions from new entrants as it scales. The Company also have expertise in crypto tracing to counter fraudsters in assisting its AML and have staff certified in tracing methodologies.

PRICING STRUCTURE

The payment processing ecosystem is rapidly changing and extremely competitive, with simple strategy we will attract our customer which included two type of business strategy: –

Personal

With personal account, we offer standard services which include sending and receiving money online from family or friends and pay for goods a customer has bought online or offline through his/her debit card, credit cards or through his HIRETT DIGITAL PAYMENTS LTD account. However, Hirett Digital Payments Ltd (“Hirett Digital Payments Ltd” as service) charges a fee, on the amount when customer sends a personal payment using a debit, credit card.

Business

Business accounts are for merchants who use Hirett Digital Payments Ltd (“Hirett Digital Payments Ltd” as service) services to sell their goods online. They pay at least a fee of 2.4% plus £0.20 of the amount they receive on the sale. However, this fee is reduced with an increased amount.

| Purchase Payments received (monthly) | Fee per trans |

| £0.00 GBP ~ £2,500 GBP

£2,500 GBP ~ £10,000 GBP £10,000 GBP ~ £50,000 GBP £50,000 GBP ~ £100,000 GBP |

3.4% + £0.20 GBP

2.9% + £0.20 GBP 2.7% + £0.20 GBP 2.4% + £0.20 GBP |

There will be no withdrawal fee for business account.

International Payments

Hirett Digital Payments Ltd charges fees when customer receives payment from a different country. The charges include currency conversion cost (if a different currency is used) and the international payment fee. Fees vary for different currencies.

Business Account Charges

Registration an individual or business account on Hirett Digital Payments Ltd is free. However, some special features and services like customized checkout page and same site payment are provided only to user who buy the pro-business account of HIRETT DIGITAL PAYMENTS LTD (payment gateway service by Hirett Digital Payments Ltd). The cost of such account is £20 per month.

| Features | Standard | Pro |

| Monthly fee | £0.00 | £20 |

| Design and host your own checkout page for full control | ✓ | |

| Accept credit and debit card via phone fax and email (virtual terminal) | ✓ | |

| Accept credit and debit cards (your buyer doesn’t need a HIRETT DIGITAL PAYMENTS LTD account) | ✓ | ✓ |

| Accept HIRETT DIGITAL PAYMENTS LTD payments | ✓ | ✓ |

| Send invoice online for fast payments | ✓ | ✓ |

HIRETT DIGITAL PAYMENTS LTD 2 HIRETT DIGITAL PAYMENTS LTD payment withdrawal fees

HIRETT DIGITAL PAYMENTS LTD 2 HIRETT DIGITAL PAYMENTS LTD let you receive money directly through a custom link. However, HIRETT DIGITAL PAYMENTS LTD charges you when you withdraw the same. The charges in UK are 2.4% plus £0.20 GBP of the amount received.

Interests from money deposited

The money kept as Hirett Digital Payments Ltd (“Hirett Digital Payments Ltd” as a service) balance will attract interest. The interest is a source of revenue for Hirett Digital Payments Ltd and is not shared with customers.

HIRETT DIGITAL PAYMENTS LTD Gateway

HIRETT DIGITAL PAYMENTS LTD Gateway is the payment gateway service provided by Hirett Digital Payments Ltd. HIRETT DIGITAL PAYMENTS LTD Gateway can be integrated into a website by anyone using a merchant account.

There are 2 plans which give different levels of customization for the online checkout pages:

- HIRETT DIGITAL PAYMENTS LTD Gateway link: The free plan where the customer enters the payment details on a page hosted by Hirett Digital Payments Ltd

- HIRETT DIGITAL PAYMENTS LTD Gateway Pro: The premium plan which gives the user the ability to design his own checkout page and price as £20 per

No matter what the plan is, Hirett Digital Payments Ltd charges a £0.10 gateway fee for credit card payments.

Besides this, the company will also provide three optional features in future. These will be:

- e-Wallet

- Recurring Billing

- Buyer authentication

- NANO Satellite Authentication

|

Small Sized Companies |

Value |

Medium Sized Companies | Value | Large Sized Companies | Value | ||

| Annual Sales | £734,694 | Annual Sales | £24,489,796 | Annual Sales | £73,469,388 | ||

| AOV | £50 | AOV | £50 | AOV | £50 | ||

| Expected Margin | £5 | Expected Margin | £5 | Expected Margin | £5 | ||

| Orders / Month | 3000 | Orders / Month | 10,000 | Orders / Month | 100,000 | ||

| Estimated Abandoned

Orders |

5000 | Estimated Abandoned

Orders |

16,667 | Estimated Abandoned

Orders |

166,667 | ||

| Base Line Conversion | 2% | Base Line Conversion | 2% | Base Line Conversion | 2% | ||

| New Conversion | 2.45% | New Conversion | 2.45% | New Conversion | 2.45% | ||

| Estimated Order with

Hirett Digital Payments Ltd |

3675 | Estimated Order with

Hirett Digital Payments Ltd |

12,250 | Estimated Order with

Hirett Digital Payments Ltd |

122,500 | ||

| Orders recaptured | 675 | Orders recaptured | 2,250 | Orders recaptured | 22,500 | ||

| Sales by Hirett Digital Payments Ltd | £33,750 | Sales by Hirett Digital Payments Ltd | £112,500 | Sales by Hirett Digital Payments Ltd | £1,125,000 | ||

| Gross Profit made by retailer | £3,375 | Gross Profit made by retailer | £11,250 | Gross Profit made by retailer | £112,500 | ||

| Licensing Fee | £150 | Licensing Fee | £5,000 | Licensing Fee | £15,000 | ||

| Net Profit | £3,225 | Net Profit | £6,250 | Net Profit | £97,500 | ||

| ROI | 2150% | ROI | 125% | ROI | 650% | ||

| New Orders / Month to breakeven | 30 | New Orders / Month to breakeven | 1000 | New Orders / Month to breakeven | 3000 | ||

| Monthly baseline | 1224 | Orders / Month baseline | 40,816 | Orders / Month baseline | 122,449 | ||

The personnel forecast below shows the staffing needs for the next three years.

|

Personnel Plan |

Year 1 | Year 2 |

Year 3 |

| Founder | £75,000 | £75,000 | £75,000 |

| Finance Manager | £75,000 | £75,000 | £75,000 |

| COO | £60,000 | £60,000 | £60,000 |

| CFO | £0 | £0 | £160,000 |

| Operations and Onboarding managers | £0 | £90,000 | £180,000 |

| Operations | £120,000 | £120,000 | £240,000 |

| Sales / Account Managers | £25,000 | £50,000 | £200,000 |

| Sr. Developer | £0 | £300,000 | £300,000 |

| Junior Developer | £0 | £150,000 | £150,000 |

| Analyst | £0 | £70,000 | £70,000 |

| Customer Service | £45,000 | £180,000 | £180,000 |

| IT Support | £75,000 | £150,000 | £300,000 |

| Total People | 8 | 19 | 31 |

| Total People | £475,000 | £1,320,000 | £1,990,000 |

|

Personnel Plan |

Year 1 | Year 2 |

Year 3 |

| Founder | £75,000 | £75,000 | £75,000 |

| Finance Manager | £75,000 | £75,000 | £75,000 |

| COO | £60,000 | £60,000 | £60,000 |

| CFO | £0 | £0 | £160,000 |

| Operations and Onboarding managers | £0 | £90,000 | £180,000 |

| Operations | £120,000 | £120,000 | £240,000 |

| Sales / Account Managers | £25,000 | £50,000 | £200,000 |

| Sr. Developer | £0 | £300,000 | £300,000 |

| Junior Developer | £0 | £150,000 | £150,000 |

| Analyst | £0 | £70,000 | £70,000 |

| Customer Service | £45,000 | £180,000 | £180,000 |

| IT Support | £75,000 | £150,000 | £300,000 |

| Total People | 8 | 19 | 31 |

| Total People | £475,000 | £1,320,000 | £1,990,000 |

BREAK EVEN

The following break-even analysis shows the revenue necessary to break-even in the first year of operation. As shown below, the Company is expected to incur average monthly costs of £57,767 in Year 1. On Average, the Company’s pays out £129 in commission to per account per month. The contribution margin of each account is £1,328 per account per month. At this rate, the Company needs to hold at least 48 retailers in its sales portfolio.

| Break-even Analysis | |

| Monthly Units Break-even | 48 |

| Monthly Revenue Break-even | £63,974 |

|

As s u m p t i o n s : |

|

| Average Per-Unit Revenue | £1,328 |

| Average Per-Unit Variable Cost | £129 |

| Average Percent Variable Cost | £- |

| Estimated Monthly Fixed Cost | £57,767 |

BREAK EVEN ANALYSIS

PROJECTED INCOME STATEMENT

| Pro Forma Profit and Loss | Year 1 | Year 2 | Year 3 |

| Sales | £541,695 | £11,963,940 | £22,808,338 |

| Direct Cost of Sales | £52,563 | £1,170,996 | £2,232,818 |

| Production Payroll | £0 | £0 | £0 |

| Other Costs of Sales | £0 | £0 | £0 |

| Total Cost of Sales | £52,563 | £1,170,996 | £2,232,818 |

| Gross Margin % | 90.30% | 90.21% | 90.21% |

| Operating Expenses | |||

| Payroll | £0 | £1,320,000 | £1,990,000 |

| Marketing/Promotion | £575,000 | £9,675,000 | £14,000,000 |

| Depreciation | £0 | £0 | £0 |

| Rent | £15,000 | £15,000 | £60,000 |

| Internet | £6,000 | £9,000 | £10,000 |

| Utilities | £5,400 | £5,400 | £7,000 |

| Hosting Fees | £1,800 | £3,000 | £5,000 |

| Licenses and Subscriptions | £3,000 | £6,000 | £10,000 |

| Supplies | £2,400 | £6,600 | £10,000 |

| Maintenance | £8,400 | £8,400 | £8,400 |

| Insurance | £7,200 | £8,400 | £8,400 |

| Professional Fees | £60,000 | £60,000 | £120,000 |

| Payroll Taxes | £0 | £198,000 | £298,000 |

| Other | £9,000 | £12,000 | £25,000 |

| Total Operating Expenses | £693,200 | £11,326,800 | £16,551,800 |

| Profit Before Interest and Taxes | £204,068 | £533,856 | £4,021,621 |

| EBITDA | £204,068 | £533,856 | £4,021,621 |

| Interest Expense | £0 | £0 | £0 |

| Taxes Incurred | £0 | £0 | £1,206,486 |

| Net Profit | £204,068 | £533,856 | £2,815,135 |

| Net Profit / Sales | -37.67% | -4.46% | 12.34% |

PROJECTED CASH FLOW

| Pro Forma Cash Flow | Year 1 | Year 2 | Year 3 |

|

Cash Received |

|||

| Cash from Operations | |||

| Cash Sales | £0 | £0 | £0 |

| Cash from Receivables | £381,879 | £10,786,500 | £21,596,218 |

| Subtotal Cash from Operations | £381,879 | £10,786,500 | £21,596,218 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | £0 | £1,320,000 | £1,990,000 |

| Bill Payments | £548,207 | £9,933,773 | £17,965,067 |

| Subtotal Spent on Operations | £548,207 | £11,253,773 | £19,955,067 |

| Net Cash Flow | £166,328 | £467,273 | £1,641,151 |

| Cash Balance | £1,283,672 | £816,398 | £2,457,549 |

PROJECTED BALANCE SHEET

The balance sheet is a snapshot of Hirett Digital Payments Ltd’s financial condition.

| Assets |

Year 1 |

Year 2 |

Year 3 |

| Current Assets | |||

| Cash | £1,283,672 | £816,398 | £2,457,549 |

| Accounts Receivable | £159,816 | £1,337,256 | £2,549,376 |

| Inventory | £0 | £0 | £0 |

| Other Current Assets | £0 | £0 | £0 |

| Total Current Assets | £1,443,488 | £2,153,654 | £5,006,925 |

| Long-term Assets | |||

| Long-term Assets | £0 | £0 | £0 |

| Accumulated Depreciation | £0 | £0 | £0 |

| Total Long-term Assets | £0 | £0 | £0 |

| Total Assets | £1,443,488 | £2,153,654 | £5,006,925 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | £197,556 | £1,441,578 | £1,479,715 |

| Current Borrowing | £0 | £0 | £0 |

| Other Current Liabilities | £0 | £0 | £0 |

| Subtotal Current Liabilities | £197,556 | £1,441,578 | £1,479,715 |

| Long-term Liabilities | £0 | £0 | £0 |

| Total Liabilities | £197,556 | £1,441,578 | £1,479,715 |

| Paid-in Capital | £2,250,000 | £2,250,000 | £2,250,000 |

| Retained Earnings | £800,000 | £1,004,068 | £1,537,924 |

| Earnings | £204,068 | £533,856 | £2,815,135 |

| Total Capital | £1,245,932 | £712,076 | £3,527,211 |

| Total Liabilities and Capital | £1,443,488 | £2,153,654 | £5,006,926 |

| Net Worth | £1,245,932 | £712,076 | £3,527,211 |

| Personnel Plan | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| Co-Founder | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 |

| Co-Founder | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 |

| COO | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 |

| CFO | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Operations and Onboarding managers | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Operations | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 | £10,000 |

| Sales / Account Managers | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 | £2,083 |

| Sr. Developer | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Junior Developer | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Analyst | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Customer Service | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 | £3,750 |

| IT Support | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 | £6,250 |

| Total FTEs | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 |

| Total Payroll | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 | £39,583 |

PROFORMA PROFIT AND LOSS

| Pro Forma Profit and Loss | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 |

| Sales | £0 | £0 | £0 | £0 | £0 | £0 | £15,795 | £31,590 | £47,385 | 98180 | £148,975 | £199,770 |

| Direct Cost of Sales | £0 | £0 | £0 | £0 | £0 | £0 | £1,503 | £3,006 | £4,509 | £9,512 | £14,515 | £19,518 |

| Production Payroll | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Costs of Sales | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Cost of Sales | £0 | £0 | £0 | £0 | £0 | £0 | £1,503 | £3,006 | £4,509 | £9,512 | £14,515 | £19,518 |

| Gross Margin | £0 | £0 | £0 | £0 | £0 | £0 | £14,292 | £28,584 | £42,876 | £88,668 | £134,460 | £180,252 |

| Gross Margin % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 90.48% | 90.48% | 90.48% | 90.31% | 90.26% | 90.23% |

| Operating Expenses | ||||||||||||

| Sales and Marketing Expenses | ||||||||||||

| Sales and Marketing Payroll | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Advertising/Promotion | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Sales and Marketing Expenses | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Sales and Marketing Expenses | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Sales and Marketing % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Expenses | ||||||||||||

| Payroll | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Marketing/Promotion | £0 | £0 | £0 | £0 | £25,000 | £30,000 | £35,000 | £40,000 | £45,000 | 75000 | £150,000 | £175,000 |

| Depreciation | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Rent | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 | £1,250 |

| Internet | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 | £500 |

| Utilities | £450 | £450 | £450 | £450 | £450 | £450 | £450 | £450 | £450 | £450 | £450 | £450 |

| Hosting Fees | £150 | £150 | £150 | £150 | £150 | £150 | £150 | £150 | £150 | £150 | £150 | £150 |

| Liscenses and Subscriptions | £250 | £250 | £250 | £250 | £250 | £250 | £250 | £250 | £250 | £250 | £250 | £250 |

| Supplies | £200 | £200 | £200 | £200 | £200 | £200 | £200 | £200 | £200 | £200 | £200 | £200 |

| Maintainence | £700 | £700 | £700 | £700 | £700 | £700 | £700 | £700 | £700 | £700 | £700 | £700 |

| Insurance | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 | £600 |

| Professional Fees | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 | £5,000 |

| Payroll Taxes | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 | £750 |

| Total Expense | £9,850 | £9,850 | £9,850 | £9,850 | £34,850 | £39,850 | £44,850 | £49,850 | £54,850 | 84850 | £159,850 | £184,850 |

| General and Administrative % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Other Expenses: | ||||||||||||

| Other Payroll | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Consultants | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Expenses | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Other Expenses | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Operating Expenses | £9,850 | £9,850 | £9,850 | £9,850 | £34,850 | £39,850 | £44,850 | £49,850 | £54,850 | £84,850 | £159,850 | £184,850 |

| Profit Before Interest and Taxes | £9,850 | £9,850 | £9,850 | £9,850 | £34,850 | £39,850 | £30,558 | £21,266 | £11,974 | £3,818 | £25,390 | £4,598 |

| EBITDA | £9,850 | £9,850 | £9,850 | £9,850 | £34,850 | £39,850 | £30,558 | £21,266 | £11,974 | £3,818 | £25,390 | £4,598 |

| Interest Expense | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Taxes Incurred | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Income | ||||||||||||

| Other Income Account Name | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Income Account Name | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Other Income | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Expense | ||||||||||||

| Other Expense Account Name | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Other Expense Account Name | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Total Other Expense | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Net Other Income | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 |

| Net Pro f i t | £9,850 | £9,850 | £9,850 | £9,850 | £34,850 | £39,850 | £30,558 | £21,266 | £11,974 | £3,818 | £25,390 | £4,598 |

| Net Pro f i t / Sal es | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 193.47% | 67.32% | 25.27% | 3.89% | 17.04% | 2.30% |

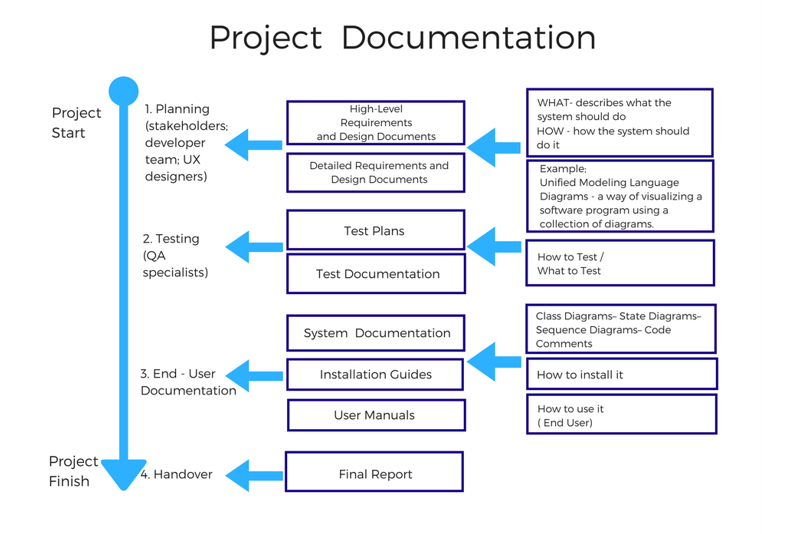

STRATEGY AND IMPLEMENTATION

Technical documentation in software engineering is the umbrella term that encompasses all written documents and materials dealing with software product development. All software development products, whether created by a small team or a large corporation, require some related documentation. And different types of documents are created through the whole software development lifecycle (SDLC). Documentation exists to explain product functionality, unify project-related information, and allow for discussing all significant questions arising between stakeholders and developers.

As an inhouse software developer Hirett Digital Payments Ltd will follow software development standards to provide more stable and secure solution to its customer.