FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

Equity Release Product Disclosure

Where The company provides equity release products, we ensure that the below information is added to and disclosed on our standard Illustration Document.

The illustration provided to a customer: –

- Contains in the illustration head section:

- the customer’s name

- the date of issue of the illustration

- details of how long the illustration is valid for, and whether there is any date by which the equity release transaction covered by the illustration needs to commence

- the prescribed text at the head of the illustration (see MCOB 9.4.17 – 9.2.25)

- Contains the material specified in section 6.10.3.2 of this manual (and MCOB 9.4)

- Is in a document separate from any other material that is provided to the customer

- Is personalised for each customer to reflect the following:

- the specific equity release transaction in which the customer is interested

- the amount of the loan or equity required by the customer, or for drawdown mortgages and instalment reversion plans, the amount the customer wishes to draw down or to receive on a monthly (or such frequency that amounts are available) Where the amount the customer can draw down is variable, we always agree with the customer an expected amount to be drawn down per year

- the price or value of the property on which the equity release amount is based (estimated where necessary)

- such information relating to the customer, or the property, or both as is necessary to determine that the customer would qualify for the equity release transaction in question

- the term of the instalment reversion plan or, in the case of a lifetime mortgage and an open-ended instalment reversion plan, the estimated term

- Never illustrates more than one equity release transaction in the same illustration

Where we are estimating the term of a lifetime mortgage or an open-ended instalment reversion plan, we always: –

- Use the following mortality table: PMA92(C=2010) and PFA92(C=2010) for males and females respectively, derivable from the Continuous Mortality Investigation Report 17, published by the Institute of Actuaries and the Faculty of Actuaries in 1999

- For the purposes of the illustration, where the table does not result in a life expectancy expressed in whole years, the term is always rounded up to the next whole year

- Where the term estimated using the mortality table set out in the above clause is less than fifteen years, we always use a term of fifteen years in preparing the illustration

6.13 Annual Percentage Rate Charge

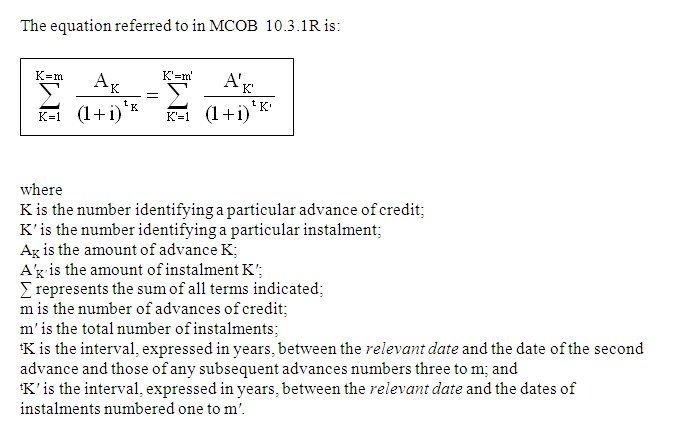

The company is required to calculate an Annual Percentage Rate (APR) as part of the services that we offer and as a firm regulated under MCOB 10 of the FCA Handbook, we always use the compliant method and equation of calculating this APR.

[If you use an alternate method to the FCA requirement, please insert below]

6.14 Alternate Mcob References

[Home Purchase Plans, Regulated Sale & Rent Back Agreements and Business Loans have specific MCOB requirements and regulations that have not been included in this manual due to the specific nature and bespoke formatting of the rules. If these apply to you, please ensure that you add these sections to the manual and include your policy, procedures and disclosures as required.]

Some MCOB rules and requirements have been included in other sections and templates of this manual due to their relevance on the section in which they appear. These sections include: –

- Remuneration

- Vulnerable Customers

- Financial Difficulties

- Financial Difficulties Policy & Procedures

- Affordability Assessment Calculator

- Responsible Lending

- Distance Marketing

- Financial Promotions & Communication Checklist

- Financial Promotions & Communication Policy Template

- Adequate Explanations & Pre-Contract Information

- Pre-Contract Disclosure Information

- Arrears, Default & Recovery

- Arrears, Default & Financial Difficulties Audit Checklist