FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

1.0 Executive Summary

ABC MONEY Ltd is a startup company providing cross-border payment and e-money solutions to individual and other businesses. The company is established in September 2020, with its office in London. The company is managed by a team experienced financial advisor, international relations, new technologies and entrepreneurship. This provides us with an in-depth understanding of the financial technology industry and client needs, as well as of the best added value services.

Credit card payments, online account, bank transfers, and international money transfer are all types of cross-border payment solutions and e-money services that ABC MONEY will provide to its customer. Customers like to pay in a way that is convenient for them. In addition to this, they want to be offered personalized options and rest assured that their payment details will be handled securely. As a result, ABC MONEY will provide multiple ways for our customers to pay across borders.

UK fintech attracted $48bn funding through 2019 according to the Pulse of Fintech H2’2019, a bi-annual report on global and regional fintech investment trends published by KPMG. The different sources consistently point to the UK as one of the top-20 remittances sending countries in the world based on the total money sent. The World Bank Annual Remittances Data suggest that in 2018 the UK occupied the 15th position, down from 10th in 2014 after China, Qatar, South Korea and the Netherlands became more prominent remittance senders than the UK. Nevertheless, World Bank Bilateral Remittances Matrix has continuously placed the UK as the fourth largest remittance sender in the world. This represent a huge market for ABC MONEY.

The rate of new patent technologies entering the industry is low, which limits the potential for innovations. A low rate does not mean that innovations cannot occur, just that the likelihood of some innovation materializing as a threat is lower. However, the concentration of technologies is high in this industry. This suggests that industry operators have exposure to potentially unforeseen areas of innovation.

We will be concentrating on both short and long-term marketing strategies. Short-term marketing strategy will help to bring about boost in patronage while the long-term plan caters for measures to be put in place for business expansion and growth in the nearest future. Its primary competitive advantage will be its unique service and the type of services we offer. Company Overview.

2.1 About ABC MONEY

ABC MONEY Ltd is a startup company providing cross-border payment and e-money solutions to individual and other businesses. The company is established in September 2020, with its office in London. The company is managed by a team experienced financial advisor, international relations, new technologies and entrepreneurship. This provides us with an in-depth understanding of the financial technology industry and client needs, as well as of the best added value services.

For us, simplicity is key, and our clients’ needs are our inspiration. When creating our company, brand and products, we took a fresh look at the basics of financial services, and added the newest technologies and insights to the modern customer’s needs. Less fuss, more transparency and flexibility, not to mention better pricing and full online management is what we came up with. Our products and solutions have no borders – we follow regulations to maintain a high degree of compliance, as well as provide quality customer service and security standards, while innovating and offering focused and digital financial products. We believe that financial technologies, or FinTech, should serve the community – the businesses and individuals who make use of them – and not vice versa.

2.2 Core Values

Security and Compliance – Our top priority is the security of our customers’ funds. Therefore, we implement the highest technological standards to ensure security, and comply with the financial regulations of FCA as well as the rules and directives of the European Parliament and the Council.

Simplicity and Clarity – We believe that FinTech does not have to be complicated for customers or for those who want to innovate.

Freedom Without Borders – We design our products and services to be fully manageable online and on mobile, providing access to global financial payment markets wherever our clients maybe.

Customer-centered and Straightforward – Our financial products and services are straightforward and transparent, easy to understand and tailored to our clients’ needs with no hidden fees.

3.0 Market Anаlуѕіѕ

UK Fintech Market

UK fintech attracted $48bn funding through 2019 according to the Pulse of Fintech H2’2019, a bi-annual report on global and regional fintech investment trends published by KPMG.

UK fintech transactions reached a six-year high and defied the global picture where fintech investment fell just shy of 2018’s record with $135.7 billion. The UK accounted for half of Europe’s ten biggest deals and over 80% of Europe’s overall, record setting, fintech funding of $58bn in 2019.

Globally, the main theme in 2019 was market diversity – with fintechs and fintech investment expanding across product, sector and geographic borders. In fact, despite various geopolitical tensions, cross-border transactions remained very high with over $50 billion in cross-border M&A deal value across 138 deals. This focus on cross-border transactions will likely continue as maturing FinTech’s look to grow and achieve scale and the big tech giants look to extend their reach and gain market share in less developed markets.

Miles Celic, Chief Executive Officer, TheCityUK, says, “As a world-leading FinTech hub, the UK offers ambitious firms a competitive base for their global growth. The UK FinTech market is showing increasing signs of acceleration, with large-scale deals and confident plans for global expansion gathering real pace. It is encouraging to see the partnership model bearing fruit, providing the right mix of capital, expertise and innovation to propel the financial and related professional services industry forward.”

“It’s been another fantastic year for UK fintech. Over the past year, the lines have really started to blur between financial services and non-financial services, with fintech companies helping to bridge the gap – we expect this trend to continue into 2020” said Anton Ruddenklau, Global Co-leader of Fintech, KPMG International. “Some of the biggest deals have been clear examples of investment in fintech solutions that are more focused on supporting other businesses digital infrastructure and this, in turn, is attracting investors towards the potential for quicker-to-profit models. Just look at how the big tech giants are working with both traditional financial institutions and fintechs in order to seamlessly integrate financial services within their ecosystems, and at how the larger fintechs and financial institutions are looking at ways to broaden their offerings into adjacent areas. There’s also been notable geographical expansion this time around, as the digital banks prove themselves shining examples of the UK’s potential as we embark on life outside of the EU.”

UK Remittance Market

The different sources consistently point to the UK as one of the top-20 remittances sending countries in the world based on the total money sent. The World Bank Annual Remittances Data suggest that in 2018 the UK occupied the 15th position, down from 10th in 2014 after China, Qatar, South Korea and the Netherlands became more prominent remittance senders than the UK. Nevertheless, World Bank Bilateral Remittances Matrix has continuously placed the UK as the fourth largest remittance sender in the world.

UK remittances overall comprise a small share of its GDP. Based on the Annual Remittances Data, in 2018 outflows were equivalent to 0.4% of the UK’s GDP. By contrast, Kuwait—one of the largest remittance senders both in terms of the total money and share of GDP sent—remitted an amount equivalent to 10% of its GDP. In fact, in 2018 the UK was only 85th out of 117 countries for which data are available according to the share of GDP that remittances accounted for. This means that the UK remits less, as a share of its GDP, than most other countries in the world, so remittance outflows are likely to have a limited impact on its overall growth, especially in light of the positive impacts immigrants have on the UK’s economic development.

The UK not only sends, but also receives remittances. In 2018, the UK received roughly GBP 4.1 billion in remittances according to the Annual Remittances inflows data, equivalent to 0.2% of its GDP. The World Bank Bilateral Remittance Matrix puts the amount at roughly GBP 3.4 billion and points to Australia and the United States as the largest remittance senders to the UK. As was the case with remittances outflows, however, it is likely that remittances inflows are also underestimated in different datasets.

UK remittance costs still exceed the goal, but they have been trending downward over the last decade

Migrants in the UK send money home using several channels. These include family and friends returning home, money transfers operators (MTOs) such as Western Union and MoneyGram, banks, and informal hawala brokers. The hawala method of transferring money is informal and it is very difficult to trace most of these flows using official government records.

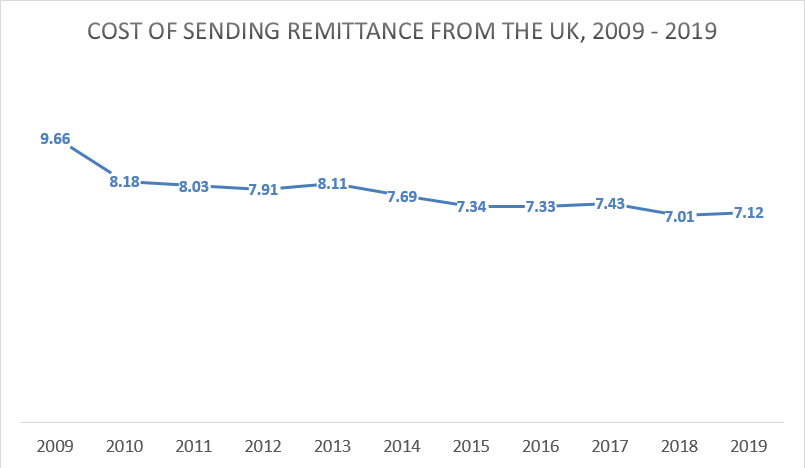

Sending remittances via MTOs and banks is typically not free. In 2019, the average cost of sending £120 from the UK abroad was roughly £8.5 (World Bank 2019d). In 2009, the UK, together with other G8 countries, set out a target to reduce the global average cost of sending international remittances from 10% to 5% of the transaction amount within five years (OECD 2011). A decade later, the UK is half-way to achieving that goal: since 2009, the cost of sending remittances from the UK decreased by 2.5 percentage points, from 9.66% in 2009 to 7.12% in 2019. The current Sustainable Development Goal aims to reduce the cost of remittance transactions to 3% by 2030.

Source: World Bank (2019d) and World Bank (2019a)

There are a few reasons why remittance costs remain high. First, in a global trend known as ‘de-risking’, banks over the last years closed the accounts of several MTOs in order to reduce risk and comply with anti-money laundering and other regulations imposed after 2008. As a result, it has become more difficult for MTOs to operate, leading to higher remittance costs. Second, cash transfers—which tend to be more expensive than digital transfers—continue to dominate the UK market, especially with regard to the developing countries. This is particularly the case when money is sent to countries with least developed domestic money payment systems.

The cost of remittances varies substantially depending on the country where remittances are sent and the method of transfer

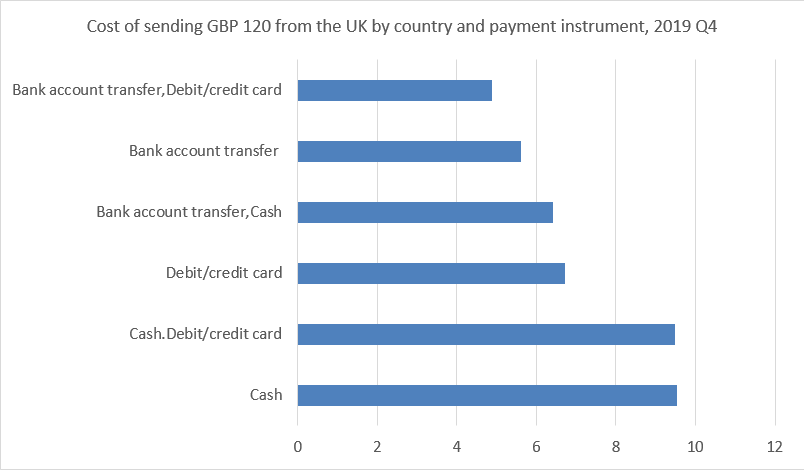

Figure below illustrates the cost of sending £120 from the UK to select countries in the world at the end of 2019. Transfer costs vary greatly: for example, the cost of sending £120 from the UK to Bangladesh using an MTO that offers cash and debit/credit card payments cost -0.18%, which means the transfer was essentially free. According to the World Bank, the negative cost may be due to a promotion at the time the price was recorded. By contrast, sending the same amount of money to Lithuania in cash would have cost 24.88% or £29.86.

Source: World Bank (2019b)

Note: Payment instrument shows how senders can pay for transfers, e.g. “Cash, Debit/credit card” means that the sender pays using either cash or debit and credit cards. The average disregards the volume of transfers completed by each instrument due to data limitations.

Cash payments tend to be more expensive than bank account transfers. Across all countries for which data are available, the average cost of remitting £120 in cash cost £11.44 or 9.54%. The equivalent cost of a bank transfer (using an operator that also offers debit/credit card transfers) was almost half the price: £5.86 or 4.88%.

In general, sending remittances to countries in the Middle East and Africa is the most expensive whereas destinations in South Asia are the cheapest. European countries are dispersed in the middle. According to below Figure, Afghanistan is the most expensive country to send money from the UK, mostly due to high fees associated with cash payments. India—where all transfer methods are below 6%—is the least costly destination.

Average Cost of sending GBP 120 by country, 2019 Q4

E-MONEY AND CROSS-BORDER PAYMENT SOLUTIONS BUSINESS PLAN

CONFIDENTIALITY AGREEMENT

The undersigned reader acknowledges that the information provided by ABC MONEY LTD in this business plan is confidential; therefore, reader agrees not to disclose it without the express written permission of ABC MONEY LTD.

It is acknowledged by reader that information to be furnished in this business plan is in all respects confidential in nature, other than information which is in the public domain through other means and that any disclosure or use of same by reader may cause serious harm or damage to ABC MONEY LTD.

Upon request, this document is to be immediately returned to ABC MONEY LTD.

__________________

Signature

___________________

Name (typed or printed)

__________________

Date

This is a business plan. It does not imply an offering of securities.

| Afghanistan | 12.68% | South Africa | 8.15% |

| The Gambia | 12.62% | Vietnam | 8.08% |

| Lebanon | 12.01% | Lithuania | 7.73% |

| Eritrea | 11.04% | Nigeria | 7.24% |

| Zambia | 10.16% | Ghana | 7.09% |

| Albania | 10.04% | Brazil | 7.09% |

| Sierra Leone | 9.71% | China | 7.05% |

| Thailand | 9.57% | Kenya | 6.35% |

| Tanzania | 9.39% | Nepal | 6.23% |

| Bulgaria | 9.37% | Romania | 6.19% |

| Rwanda | 9.10% | Poland | 5.14% |

| Jamaica | 9.08% | Philippines | 4.89% |

| Ethiopia | 8.84% | Sri Lanka | 4.66% |

| Somalia | 8.71% | Pakistan | 4.28% |

| South Sudan | 8.66% | Bangladesh | 3.98% |

| Uganda | 8.65% | India | 3.78% |

Source: World Bank (2019b).

Note: Average indicate the average cost across payment instruments. The figure disregards volume of transfers due to data limitations.

3.1 Future Market Payment

In a new world of open banking and APIs, the greatest value exchange taking place on payment systems will be found in transactional data rather than the transactions themselves. Such data will unlock a huge variety of new opportunities, from combatting fraud to sophisticated financial planning for consumers, with corporate customers benefitting too. Those organisations with the ability to use this data to best effect will secure competitive advantage; this will mean data analytics tools and artificial intelligence (AI) become the most important technologies in the payments sector; skills in these areas will be at a premium.

Fundamentally, data has the potential to transform the payments industry value chain. For example, corporate customers will increasingly value the insights unlocked by payment data and consumers keen to pay less for payments will be able to do so by agreeing to share more of their data.

However, to achieve these goals it will be crucial to establish greater international consistency on data protection and privacy laws. Debates over what standards should apply on a global scale, who should control data and how the rules are enforced, will have to be conducted in the wider context of the debate around protectionism and free trade, particularly given the power of the technology giants of the US and China. But reaching agreement on data privacy will be a vital step towards unlocking its value.

Distributed ledger technologies will underpin a globally connected, high-speed payments network. Real-time payments will become the norm, even for cross-border transactions.

Distributed ledger technologies have the potential to be the primary means through which we deliver the payments system of the future. Cloud computing and API tools will link technology to create cross-border, high-speed networks: an ‘internet of value’ through which payments flow unhindered, just as information currently flows around the worldwide web. An increasing number of payments will be made via these technologies, which will largely be operated by private sector organisations from the banking or near-banking sector.

Such a network has the potential to deliver more than just transactional services. For example, linking payments to the supply chain via distributed ledger technologies will transform supply chain management and tracking.

Nevertheless, the most visible consequence of the emergence of distributed ledger technologies as a key support for the global payments system will be that real-time payments become a standard commodity. As technology dissolve the borders between domestic settlement systems, payments will be instantaneous, even when they are cross-border. This will begin to have fundamental impacts: for example, making high-volume transfers of micro-payments – an atomisation of the payments system – economically viable; but it also means that banks will need to be able to manage their liquidity in real time, which remains a key challenge today.

3.2 COVID-19 Impact on Market Trend

Remittance flows in 2020 to low- and middle-income countries (LMICs) are projected to fall by 19.7 per cent to USD 445 billion, one of the sharpest declines in recent history. According to the World Bank, this fall is largely due to the economic crisis caused by the COVID-19 pandemic; for migrant workers, the pandemic has meant a fall in wages and employment.

The World Bank projects a decline of remittance flows across all regions: Europe and Central Asia (-27.5%); Sub-Saharan Africa (-23.1%), South Asia (-22.1%), the Middle East and North Africa (-19.6%), Latin America and the Caribbean (-19.3%), and East Asia and the Pacific (-13%).

This decline comes after remittances to LMICs reached a record USD 554 billion in 2019, overtaking Foreign Direct Investments (World Bank, 2020). In 2019, in current USD, the top five remittance recipient countries were India (83.1 billion), China (68.4 billion), Mexico (38.5 billion), the Philippines (35.2 billion), and the Arab Republic of Egypt (26.8 billion). In relative terms, the top 5 countries which received the highest remittances as a share of gross domestic product (GDP) in 2019 were: Tonga (37.6% of GDP), Haiti (37.1%), South Sudan (34.1%), the Kyrgyz Republic (29.2%), and Tajikistan (28.2%).

In the first quarter of 2020, the average costs of sending USD 200 to LMICs remained high at 6.8 per cent, well above the target of 3 per cent of the Sustainable Development Goal 10.c.1. Sub-Saharan Africa continued to have the highest average remittance costs, at about 9 per cent; South Asia had the lowest average remittance costs at 4.95 per cent. The average remittance costs for the remaining regions were: Europe and Central Asia (6.48%); East Asia and Pacific (7.13%); Middle East and North Africa (7%); and Latin America and the Caribbean (5.97%).

4.0 Competitor Analysis

TransferWise

TransferWise, the money transfer company that’s taking on Western Union, is valued at $3.5 billion after a new investment round, making it Europe’s most valuable financial technology start-up.

In lowering fees and adding a slick online platform to help consumers move money globally and track their transfers, the London-based company is taking a modern approach to a staid business that’s been dominated by giants like Western Union and MoneyGram.

The company says it’s been pushing for more transparency around the fees banks and currency exchange services charge their customers for transferring money abroad.

TransferWise isn’t adding fresh cash to its balance sheet with the investment, but is instead giving employees and early investors the chance to sell some of their stake in a $292 million secondary deal.

TransferWise booked a net profit of £6.2 million ($7.9 million) for the fiscal year ending March 2018, while annual revenue almost doubled to £117 million. The company says it’s signing up 10,000 new business customers a month, and now has 5 million total customers, processing £4 billion in monthly transactions.

Revolut

Revolut is a fintech company that provides a debit card and a Swiss Army knife of an app, packed full of features including (hold your breath): a current account, peer-to-peer payments, currency exchange, multi-currency cards, day-by-day in-app insurance purchases and the option to buy cryptocurrency.

The company has been in the news for its aggressive expansion into dozens of countries, monster valuation and fundraising rounds, its ongoing battle with the likes of Monzo and Starling Bank in the UK and its apparently cut-throat working environment – Revolut’s company slogan is “Get shit done”.

Quick stats

- Who founded Revolut?Nikolay Storonsky and Vlad Yetsenko in July 2015.

- Where is Revolut’s headquarters?Revolut is headquartered in London, with offices in more than 20 locations worldwide.

- How much funding does Revolut have?Revolut’s total funding is £627 million.

- How much revenue does Revolut make?Revolut made £58.2 million revenue in FY 2018.

- What’s Revolut’s valuation?Revolut has a $1.7 billion market valuation (as of 26 April 2018).

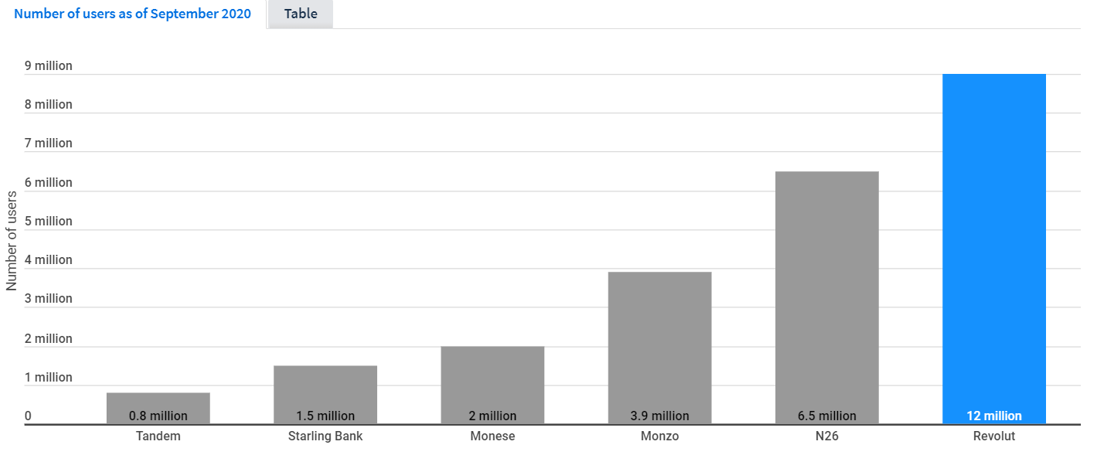

- How many customers does Revolut have?Revolut has over 12 million customers and supports usage in 35 countries.

Revolut’s growth over time

Since launching, Revolut has achieved the sort of growth entrepreneurs and CEOs dream of. By opening offices in over 20 countries, Revolut has been able to expand aggressively and beat competitors to the punch in different markets. Today, it has offices in London, New York, Singapore, Berlin and more.

Revolut has more than 12 million users, with an ambitious goal to onboard 100 million within 5 years. The company said in 2019 that it had 250,000 daily active users and numbers continue to grow.

Revolut dwarfs the competition when it comes to user numbers

With a steady increase, 440,000 customers join Revolut every month on average. In December 2020, the number of customers is projected to be 16.45 million, compared to the current 12 million (August 2020).

| Level |

Factor |

Disruption |

Description |

| Very High | Market Concentration | Very Likely | A ranked measure of the largest core market for the industry. Concentrated core markets present a low-end market or new market entry point for disruptive technologies to capture market share. |

| High | Innovation Concentration | Likely | A measure for the mix of patent classes assigned to the industry. A greater concentration of patents in one area increases the likelihood of technological disruption of incumbent operators. |

| Low | Ease of Entry | Unlikely | A qualitative measure of barriers to entry. Fewer barriers to entry increase the likelihood that new entrants can disrupt incumbents by putting new technologies to use. |

| Low | Rate of Entry | Unlikely | Annualized growth in the number of enterprises in the industry, ranked against all other industries. A greater intensity of companies entering an industry increases the pool of potential disruptors. |

| Low | Rate of Innovation | Unlikely | A ranked measure for the number of patents assigned to an industry. A faster rate of new patent additions to the industry increases the likelihood of a disruptive innovation occurring. |

The rate of new patent technologies entering the industry is low, which limits the potential for innovations. A low rate does not mean that innovations cannot occur, just that the likelihood of some innovation materializing as a threat is lower. However, the concentration of technologies is high in this industry. This suggests that industry operators have exposure to potentially unforeseen areas of innovation.

There are both significant barriers to entry and a low rate of new entrants in this industry. This combination of factors dampens the threat of innovative players disrupting the industry structure.

The major markets for this industry are highly concentrated, which implies that the market has a focus on key customer segments. This presents an opportunity for strategic entrance into lower-end markets or unserved markets for innovations to take on a disruptive trajectory.

Automated clearinghouse

The automated clearinghouse (ACH) is an electronic payments system that consists of a data processing and communications hardware and software infrastructure designed to deliver and settle large volumes of electronic payment transactions and related information.

In September 2009, financial institutions had to install and test software for the new International ACH Transaction code. The new code format helped financial institutions comply more easily with anti-money laundering rules by distinguishing cross-border ACH transactions from domestic transactions. The new international transaction format includes specific data defined by the Bank Secrecy Act’s Travel Rule. By creating these rules, standards, and new operating procedures and guidelines, banks and clearinghouse systems are able to communicate with one another more easily. The ACH payments system will continue to develop in line with increases in e-commerce and m-commerce transactions. The system makes processing payments much easier for industry participants and has a positive effect on industry profit. As technologies such as ACH continue becoming more mainstream, labor costs and other costs (e.g. transportation, supplies) associated with processing a payment decrease. In the next five years, ACH and other similar technologies are expected to increase revenue per employee.

5.0 Product and Service

5.1 Product/Service Description

Online IBAN Account

Online Current Account with Up To 3 Secondary Prepaid Cards

The IBAN account is issued without a credit history check, can be topped up in several ways, and is suited for all incoming and outgoing payments, including SEPA. With this account, online purchases will be safe and private as well as within the intended budget. Up to three secondary cards are allowed to be linked to the main account, a great solution for managing family financial needs. The user-friendly client ABC MONEY portal and mobile app ensure easy management of customers account wherever they are.

The best alternative to your regular bank account. Receive salary, transfer funds, pay bills, shop online. Verify your account to enjoy maximum ABC Money online current account limits.

Mobile Application

On-The-Go with ABC Money Mobile App.

The ABC Money Mobile App serves as a versatile lifestyle and lets customer manage their money securely, simply and effective anywhere. App will be available for download on the AppStore or GooglePlay. Customer sign in to gain access to all activity as well as make payments and manage card loads on-the-go. Enjoy the freedom of being in control of your personal budget no matter where your life takes you.

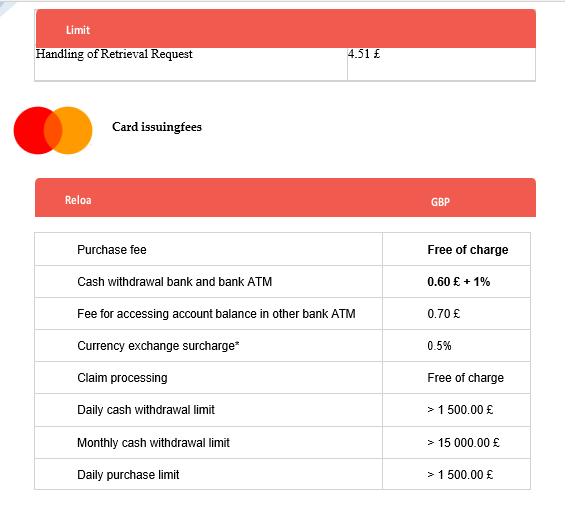

Prepaid Mastercard with contactless payments

Customers will be allowed to get a Prepaid Mastercard In Few Easy Steps.

Click the button below and fill out the simple form. Once you receive the confirmation e-mail – your account is open! Now, your ABC Money Prepaid Mastercard will be delivered to your home within 10 business days. You can activate your card in the ABC Money customer portal and load it with money to start enjoying the benefits right away. Additionally, you can become a verified customer via a simple identification process to expand your spending and deposit limits. To do so, you can complete this verification procedure in the customer portal by uploading copies of your proof of residence (e.g., a utility bill) and identity (e.g., a passport or ID card). We will review your request in the following day to verify your account as soon as possible.

ABC Money prepaid Mastercard can be used in ATM’s, online and retail stores at over 30 million locations worldwide. Supports fast and secure contactless payments.

Various Top-up Option

Choose Your Preferred Top-Up Option

You can receive local and international bank transfers to your card’s IBAN account, make instant transfers between ABC Money cards. Become a verified customer and enjoy significantly expanded loading and spending limits for more freedom.

ABC MONEY Kids Debit Card ?

ABC MONEY Kids Debit Card is a card for young people aged 7 to 17. This gives them the freedom to manage their money and learn essential financial skills, but for added security and peace of mind, it’s up to parent control.

ABC MONEY Kids Debit Card is more than just a pocket money account. This is a way for kids to learn to save and budget – because let’s be honest, they don’t learn it in school!

ABC MONEY Kids Debit Card at a glance ⚡

- Available for children from 7 to 17 years old

- Can only be configured by a parent or guardian with an existing ABC MONEY Card account

- Funded by a parent or guardian from their main ABC MONEY Card account

- The parent or guardian can control the security features of the Kids card holder

- Instant notification over the phone to parent or guardian when the ABC MONEY Kids Debit Card is used

- ABC MONEY Kids Debit Card is an excellent way for young people to acquire essential knowledge about money.

- Card details will be printed on the back of the card, to reduce risk if the card is displayed on social media

Credit card payments

Credit cards play an important role in cross-border payments and are an option for many consumers. From the consumer’s perspective, they have to enter their card details and wait for the transaction to be verified. Behind the scenes, more is happening. Cross-border payments require more work from the involved credit card networks and acquiring banks, as they need to convert between two different currencies. This additional workload results in an increase in fees that are passed through the payment chain. Nevertheless, ABC MONEY have put in place technology that will make this lengthy process seamless and processed within a blink of an eye.

Bank transfers

International bank transfers are another age-old way of making a cross-border payment. Most larger banks will have a limited range of coins stored, but it is impossible to accommodate more than a handful at any one time. Therefore, when a customer in the UK is looking to transfer money to a country where they do not have the currency in stock, they will have to rely on their foreign banking partners to design the transaction. Smaller banks often don’t have foreign currencies, so turn to big banks to make cross-border payments on your behalf.

This is just a snapshot of cross-border payment processing, and there may be many more parties involved causing delays in the transaction. ABC MONEY has partnered with SWIFT gpi to speed up the processes behind cross-border payments.

5.2 Risk Management

The management of ABC MONEY understands the challenges relating to the risk connected to its services that speaks professionalism and quality service delivery. Systematic risk management techniques will be applied to the business base on our director experience. Personnel representing ABC MONEY will pay positive attention to all aspects of the day-to-day activities. It will be fully conscious of the known risks and prepared for unexpected risks that might emerge.

The following risk assessment methodology will apply:

Risk Factors

Risk #1 – Distinguishing ABC MONEY brand in cross-border payment industry

Mitigation Strategy:

- Plan and execute operational strategies professionally.

- Continually improve on customer service and build a relationship with core targets in the market.

- Maximize viral marketing activities.

- Develop strong online and on-site affiliations.

Risk #2 – Retaining a Loyal customer base

Retention of the existing client is always easier than finding new ones.

Mitigation Strategy:

- Review the company strategies based on feedback from clients.

- Exceed customer expectations and deal with problems professionally.

- Reaching and creating market awareness that influences increased customer service.

- Strengthen ABC MONEY brand through content marketing (e.g., through blog and content marketing)

Risk #3 – Low Barriers to Entry

New Competitors with similar services could arrive the market.

Mitigation Strategy:

- Be thorough and professional.

- Develop a brand relationship that inspires loyalty.

- Hire competent and experienced professionals.

- Develop a structured feedback mechanism.

5.3 Keys to Success

ABC MONEY recognizes that success in the business is based on unconditional commitment and focus on transforming business goals into success. Being a company with the responsibility to serve people/organizations in terms of creating payment solutions. We believed that the most important factor that defines customer satisfaction is value.

Keys to success include:

- Access to the latest available and most efficient technology and techniques: Access to the latest available and most efficient technology enables companies to process more noncash payments at a lower cost, which improves profitability and generates more revenue for industry players.

- Low operating costs: Being able to minimize transaction costs is critical because it enables companies to be more competitive and increase their profit margins.

- Use of specialist equipment or facilities: Processing large volumes of payment transactions requires industry participants to use and have access to technology and equipment that can successfully carry out these transactions.

- Ability to effectively change community behavior: Providers of payment services heavily rely on the acceptance of emerging payment methods. The way they manage these relationships and their responsiveness to the communities’ needs is an integral component of their success.

- Economies of scale: Per unit and average costs of transactions can be reduced if economies of scale are achieved. This is particularly important to the industry, which is experiencing increased competition.

- Comply with government regulations: The ability to quickly change operations and procedures to adapt to increasing government regulation contributes to a company’s success.

6.0 Strategy and Implementation

6.1 Advertising Strategy

The goal of the advertising strategy will be to raise awareness levels regarding our present in the UK. We will employ several marketing outlets:

- Print media advertising: Migrant magazine and publications will be used with expansion to different cities.

- Flyers: Passed around to local store with coupons attached to introduce shoppers to ABC MONEY LTD platform and creating an economic incentive to try it.

- Social media coupons: Presented within the first six months of entering a market. The effectiveness of these coupon diminishes after approximately six months and ABC MONEY LTD will turn to more cost-effective marketing expenditures.

6.2 Marketing Strategy

We will be concentrating on both short and long-term marketing strategies. Short-term marketing strategy will help to bring about boost in patronage while the long-term plan caters for measures to be put in place for business expansion and growth in the nearest future.

The 4P’s to Success

- Positioning: ABC MONEY LTD will be positioned itself as the most reliable cross-border payment solution and e-money provider with a constant wide array of services at a minimal charge to our customers.

- Place: We will be operating across all cities in the United Kingdom. We will not be restricted by location as our solution is deployed in the cloud.

- Pricing: Good products definitely do not come cheap, but we are sure we are going to work towards fixing fees that will be pocket friendly. Our various customizable products and services might not come cheap when compared to our competitors, but we will try as much as possible within our strength to strike a balance between making profits and satisfying our highly esteem customers, most especially giving back to the community we represent.

- Promotion Strategy: We will depend on word of mouth, client referrals, community exposure and direct mail campaigns as a way to reach and expand our customer base. However, we intend to explore every avenue that is fundamentally connected to ABC MONEY LTD promotional success.

6.3 Competitive Edge

The company will capitalize on its reputation for quality and excellent customer service. The company’s experience in vital decision areas is also another area of strength. These strengths are the building blocks for the company to succeed in the industry.

ABC MONEY’s competitive edge lies in its target market and the vision of the company. The long-standing profitability of a service firm of this type lies in the repeat customer that finds ABC MONEY services an excellent experience and better services. ABC MONEY will try to obtain and to examine all features of the service experience to find any means to do better on its customer satisfaction. In addition, all employees will be carefully and diligently trained and retrained to put customer satisfaction first in order to make a self-sufficient company culture that focuses around this issue.

The company’s primary competitive advantage will be its unique service and the type of services we offer. The experience and expertise in providing affordable and comfortable payment solution provide the company edge over its competitors, especially in determining the right exchange rate, financial planning, insurance, and kids account.

Lastly, the company will take advantage of the shortfall of the competitors. ABC MONEY will turn all competitor’s weakness to our own strength, thereby providing customers with on-demand services that competitors can’t offer.

6.4 SWOT Analysis

ABC MONEY forecast its strength as the ability to respond quickly and positively to market demands. In addition to this, an attitude of overall company excellence, visible and dynamic marketing effort, accompanied by sufficient financial capabilities. We intend to become a force to reckon within the market.

The founder’s driving force and thorough knowledge of the industry would help the company to penetrate the market expansively and professionally.

The SWOT analysis presented below is designed to shed further light on the competitive environment surrounding ABC MONEY LTD.

| Strengths | Weaknesses | Opportunities | Threats |

| Broad portfolio of technology-based cross border payment solution. | Dependent of other platform API to process transaction | Increased rate of money transfer worldwide | Strong competition in cross-border payment solution |

| Worldwide payment solution with low transaction fees. | History of financial woes | Shift from traditional banking to mobile banking | Compliance measures and pricing pressure |

| Strong technology infrastructure and digital capabilities. | Poor credit rating to impact fund raising and business outlook | Ability to target more than 1 billion customers |

6.5 Marketing and Advertising Tools

Social Media

A solid online presence represents an inexpensive promotional and informational strategy. ABC MONEY LTD shall operate social media platforms such as Twitter, YouTube, Facebook etc. Social media will be used as a key tool towards marketing our products while utilizing the prospects in social media to spread information about what our company stands for in the online market. It is expected that engaging social media would enhance the brand exponentially through its easy to use interface and referral mechanism. However, the goal of social media marketing is not to make sales but to gain followers. The more followers ABC MONEY LTD have; the more people see the company’s ads when it’s run on its social media pages. We shall use Pay per Click (PPC) strategies to gain followers and likes and hire a full-time social media professional who can handle the day to day advertising on platforms as Facebook, Twitter, Instagram and Google Ad Word. However, activities on social media include the following:

- Facebook: We shall post relevant contents on a daily basis on our Facebook page, including keeping followers updated on important information about our services. As part of the plan, the company would launch Facebook campaign ads to reach prospective customers.

- Twitter: We shall maximize the marketing potentials embedded on Twitter. The company will tweet contents using relevant hash tag based on its marketing goals/strategy and re-tweet follower’s tweets when is in use. The company will support followers, steer conversations and create a buzz in the space.

- Blog: Blogger outreach is hugely an effective strategy needed to obtain relevant backlinks back to our website. Although search engines are paying careful attention to how backlinks are obtained, legitimate backlinks still earn a lot of search engine love. Additionally, we shall post our blog articles on a weekly basis to inform prospective clients about the function of our services and the advantages in using them.

Website/Mailing Effort

The utilization of email marketing and advertising would be fundamental to promoting ABC MONEY LTD online. However, this is not only part of the company’s core marketing channels but also one of the most marketing tools available today. Online marketing generally provides a cost-effective, easy to use way to reach potential clients. Therefore, we will organize a mass mailing advert campaign, send direct mails to potential clients, then follow up with mails that ensure positive responses. The company will also need to utilize online marketing campaigns on sites that relate to needs for the professional online marketplace. These adverts would help to reach core clients and create a one-click gateway to redirect prospective customers towards ABC MONEY LTD. On the company’s website, feedback mechanisms for contacts and general inquiries needed to generate and manage leads shall be made available.

Search Engine Optimization (SEO) or Search Engine Marketing (SEM)

Internet searches are by far the most common activity on the internet. Therefore, it is crucial to appear among top results when a user searches for keywords related to the online marketplace, online services, and more. The company will implement an aggressive SEO strategy, whereby it will optimize content using keywords that are peculiar to its business activities. By optimizing the website’s content, we will organically aggregate higher on Google, Bing, and other search engines.

ABC MONEY LTD will utilize Google search campaigns to target its customers. This will include pay-per-click campaigns that target high search volume terms so as to drive traffic to the website. The ongoing protective work will include:

- Redirects

- URL mapping

- Navigation

- Canonical URL Tags

7.0 Financial Plan

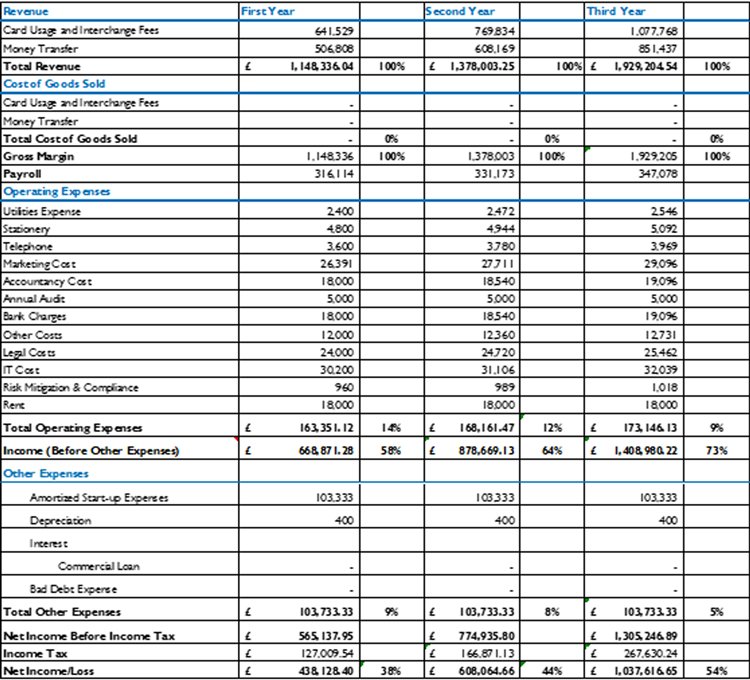

7.1 Income Statement Forecast

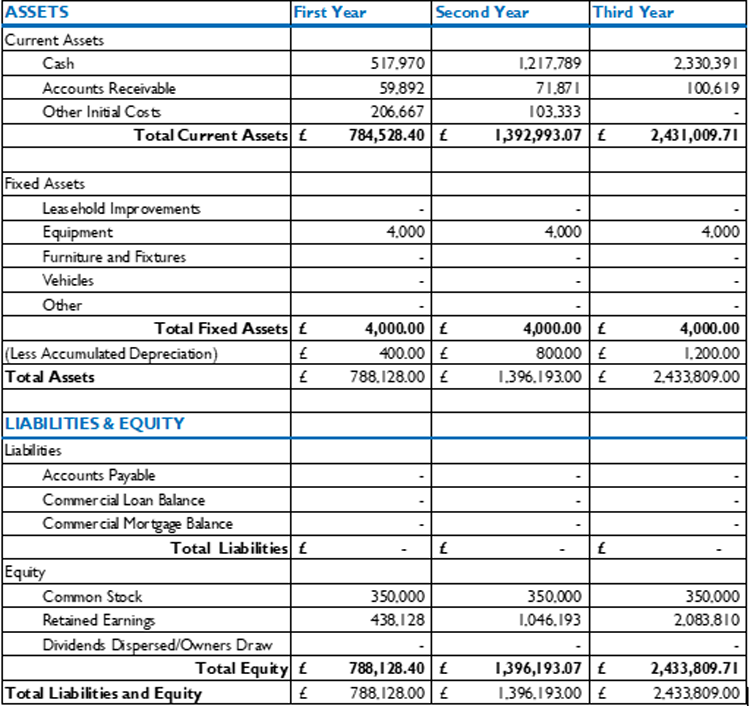

7.2 Balance Sheet

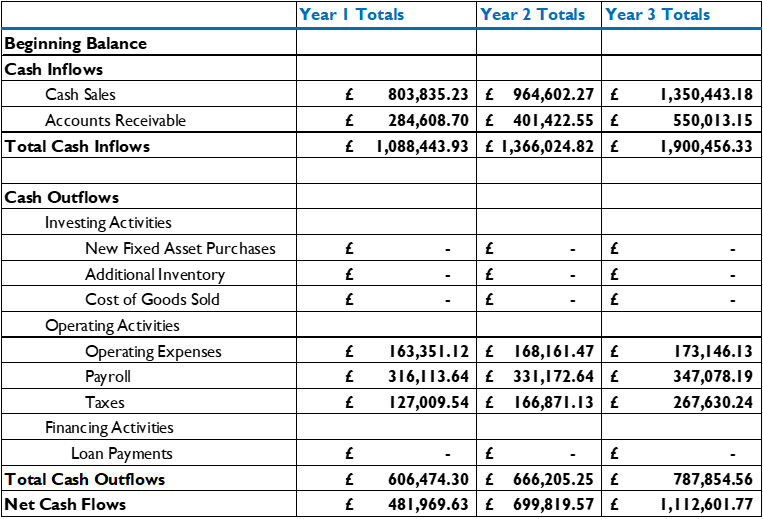

7.3 Cash Flow Statement