FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

FCA and PRA licenses (authorisations) and ongoing compliance support, training, recruitment. Contact us 7 days a week, 8am-11pm. Free consultations. Phone / Whatsapp: +4478 3368 4449 Email: hirett.co.uk@gmail.com

1. Review & Approvals

This document requires review and approval as it may be released to third parties as part of Hirett Ltd (Hirett) planning and decision management process.

This document is approved by the following representative(s) of Hirett:

| Name | Title | Signature | Date |

| John Scott | Marketing Consultant | Digital | 28/09/2020 |

| Nikki Castro | Compliance Officer | Digital | 05/10/2020 |

| Shannan Adarna | CEO | Digital | 12/10/2020 |

2. Executive Summary

Hirett Ltd (hereinafter referred to as ‘Hirett’) is a start-up company positioning itself to become the market leader in offering Pre-paid Debit Card and Virtual Bank Accounts to the UK and EU consumer and corporate customers.

The company utilizes an innovative approach, giving uniformity to a portfolio composed by all the new features made possible by technology with the recent developments, in order to satisfy both explicit needs and those that are not yet evident. Our approach is based on the following concept: “innovation is mostly built on the recombination of already existing ideas”. Leveraging on the early-mover advantage, Hirett positions itself for rapid growth and gains a strong opportunity to raise entry barriers for possible competition.

The Hirett’s challenge is to achieve the ability to turn existing products or services offered by traditional financial institutes into digital variants, and thus offering advantageous over tangible products.

“We want to become a valid replacement for any other bank account in the markets we operate in”.

3. Background to the business plan

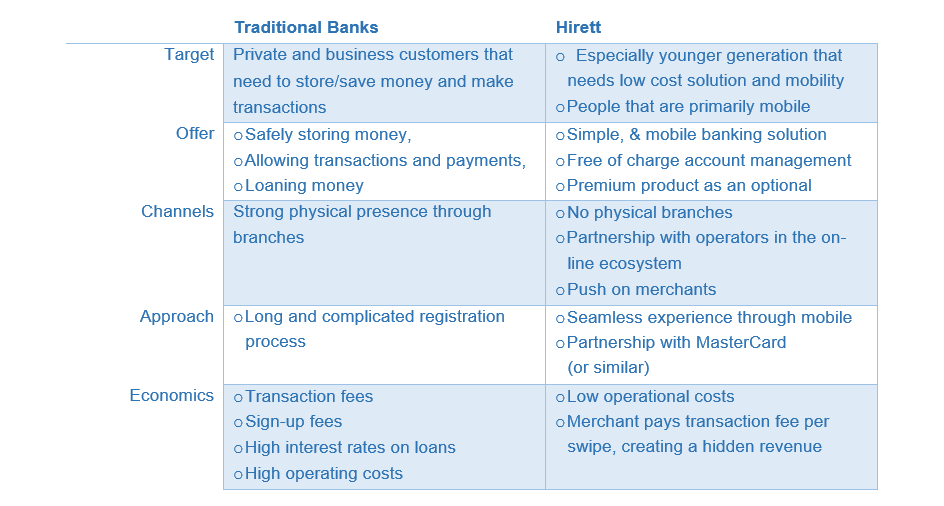

The traditional market of Retail and Commercial bank can be quickly depicted in the following way:

The above does not satisfy the majority of customer problems, which revolves around usability and costs. From the point of view of usability, it is important to note;

• Keeping up with bank account transactions is complicated because banking solutions are usually not mobile enough

• Especially young users need an easy tool to control their budgets

• People are increasingly using their smartphones to check important financial information And in terms of Costs:

• Transaction fees are usually high

• Banks are not transparent about their cost structure

• Young people are price sensitive

The result of the above has led to an increased level of complaints, which mostly consists of;

• Opening a bank account is binding

• Bank charges are very high

• Visiting a bank is not always possible and practical

4. Challenges faced by Hirett

The challenge for Hirett is to overturn the traditional paradigm of banking services as we know them today, taking advantage of the new possibilities offered by technology and the massive diffusion of access to the Internet, especially from new generation mobile devices, such as smartphones and tablets.

One of the most important growth in the financial sector is that of the mobile banking services

Another challenge is how to adjust retail banking to the modern, mobile lifestyle of today’s customers. The number of Financial Technology (FinTech) operators that challenge the traditional financial service sector as it has been for decades is increasing steadily all over the world. Since the acceptance and development of these, FinTech operators are now more often true competitors to renowned banks, insurances, or similar financial institutes. Some of them have recently obtained a full banking license and the surpassing of the one million customers threshold. Not only does this case reflect a modern and growing sector, but many of the start-up also have gained a lot of attention from the venture capital (VC) industry.

Five years ago, FinTech approach to banking services was considered unrealistic by industry experts. Nowadays, thanks to the advent and success on the market of operators like N26 and Revolut it is clear to everyone that we are at the dawn of a new era.

In the next 5-10 years some of traditional players will accelerate their digitalization efforts successfully, and others will fail, resulting in incredible shifts in market share.

Finally, as to PSD2, the directive will bring significant changes to the banking industry for years to come and will drive innovation and competition in the UK and the European market. On the one hand, it offers tremendous opportunities for financial institutions, but also for technology players, to better fulfil the business needs of customers. As for customers, accessing the best products in the market from various providers will become much more convenient. Having an account with one bank does not necessarily mean that you have to use it for all other financial products and services.

5. Services, clients and distribution channels

Hirett will provide e-money services, which typically involves use of computers, mobile devices (smartphones and tablets) and the Internet. E-money is convenient because it doesn’t require the consumer to carry cash and can be used for making purchases and receiving payments any time, 24 hours a day, seven days a week.

The Hirett systems would act as an e-money intermediary to the bank and allow users to exchange money digitally, which can then be used for multiple purposes including;

• Withdrawing at the ATM,

• use for digital or other purchases,

• for international money transfers and /or

• deposited in the bank of the users’ choice.

Hirett offer will differ from that of traditional banks as indicated below:

The Hirett project is mainly focused on providing people a natively mobile / virtual bank account with a prepaid MasterCard (or similar). This is because in recent years, it is proven that a segment of customers is eager to trust and prefer to use an app-bank with a suite of mobile banking services designed for smartphones and addressing the main needs in full mobility.

Furthermore, the major difference between us and the traditional banks, is that we operate on a much lower cost base without an expensive branch network and outdated IT systems which require high maintenance costs. We pass these benefits on to our customers.

6. Key to success

Hirett has identified the below as the keys to success:

• Development of a premium level customer services. This will be achieved via a robust software engine that ensures a seamless management of all the business activities including a version of concierge services.

• Formation of strategic relationships with online merchants, shippers, credit card companies and all the other stakeholders. The relationships with merchants will allow Hirett to quickly grow their customer base of retailers served, as well as to promote the offering to the end customers.

• Partnerships with credit card and other e-money operators, which will lead to additional sources of revenue.

• Digitalization with the ability to understand how to turn existing products or services into digital variants, and thus offering advantage over traditional products, (i.e. easier and faster distribution). Ideally, the digitalization of a product or service should be realized without compromising the value proposition which is offered to the customer. In this area, Hirett will offer 24/7 mobile access to information and possibility to make transactions through an app instead of needing to go to an agent or branch.

• Cross Selling. The concept that the account holder is ‘directly responsible’ for generating income of the bank in the form of various fees and charges has to be abandoned. Instead, the main source of revenues comes from third parties, with cross-selling free or low-priced products. The basic idea is the separation between revenue and customer. Hirett would receive a small fee from merchants per transaction made by the customer, who enjoys the service for free.

• Open Business Model. In open business models, collaboration with partner in ecosystem becomes a central source of value creation. Companies pursuing an open business model actively search for novel ways of working together with suppliers, customers, or partners to open and extend their business. The objective of Hirett is to expand their network of partners that guarantees that the customer can access their services everywhere for free.

• Agility. We must remain an agile company. The factor for success for larger companies is to retain their innovation power, regardless of whether they have 300, 600, or more employees. This is one of the most significant challenges.

The commitment of Hirett and its management is to address the success factors described above at the best.

7. Marketing Plan

As for our primary target, the majority of our customers are so-called ‘digital natives’ up to 35-years old. However, we estimate that in some cases 40 percent of our customer base is likely to be over that threshold. We think it’s fair to say that Hirett will be attractive to all digital customers who are looking for an easy to use, fast, transparent and contemporary enterprise mobile experience.

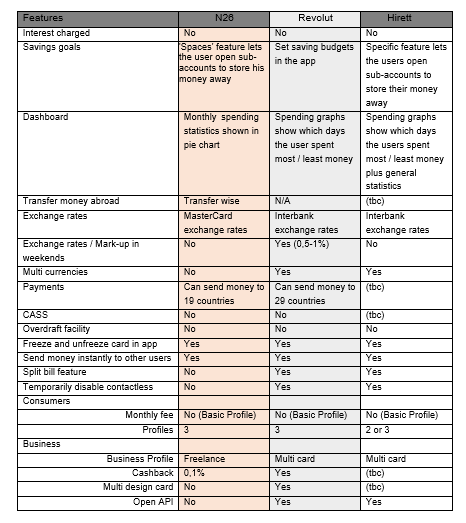

The main objective of Hirett is to reach a customer base of 200,000 over a period of 3 years. In order to provide a quick comparative analysis, following table could be taken in consideration:

Competition is not limited to challenger and incumbent banks. The biggest competitive threat, in perspective, will set to emerge from tech giants like Apple, Amazon, Facebook and Google, since they have the customer data, capital and the employees to easily break into the banking space.

8. Pricing

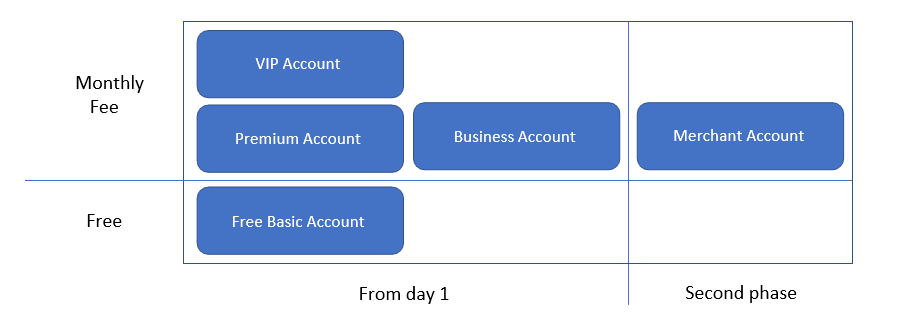

Hirett employs a freemium model, by which the firm offers clients a free basic account offering currency exchange at the live currency conversion rate. In line with this freemium strategy, clients can opt to pay for additional services like premium offering, (premium and VP account, eventually with cash back and additional features), business accounts (multi users / multi cards account, with an administrator), and in a second phase of the project a specific account for merchants.

This model should allow Hirett to grow at a fast rate without spending huge amounts of money on marketing, relying instead on referrals.

This strategy should work well as although most customers will start off using the Hirett prepaid card as a way to save costs while traveling, more and more customers will use Hirett as their daily spending card.

It is also in this context, that Hirett is looking to significantly expand its services to include offerings like, Euro direct debits, Business accounts, Concierge service, etc, just to mention some of them.

In simple words, our strategy is not building only one product, but building a platform with a lot of products on top of it. We also want to make life easier for our customers. If we offer them a service, they must feel comfortable that that service is offered to better market conditions, especially in economic terms.

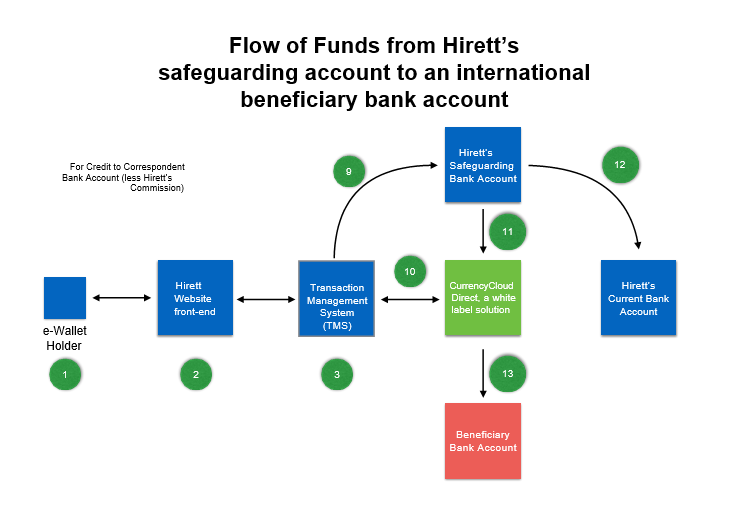

9. Flow of Funds

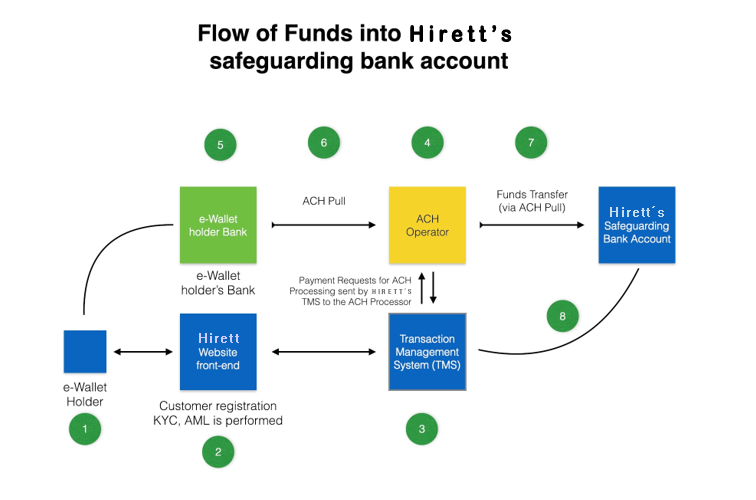

[1] e-Wallet account holder signs up using Hirett’s white-labelled website

[2] All e-Wallet account holder registration, AML, KYC, etc. is performed on this website

[3] The core of this entire flow of funds system is Hirett’s TMS (or Transaction Management System)

For an ACH pull

[4] When a e-Wallet holder [1] wants to deposit, for example £100 into their e-Wallet account, the TMS [3] will send a request for the same to the ACH Operator

[5] The ACH Operator [4] will then send the request to pull the funds from e-Wallet holder’s Bank Account

[6] These Funds will then flow to Hirett’s safeguarding bank account

[7] Thus completing the e-wallet holder fund deposit request via ACH Pull

[8] The e-Wallet account holder’s account in TMS is updated with balance of £100

When a e-Wallet holder [1] wants to make an international money transfer, for example £100,

When a e-Wallet holder [1] wants to make an international money transfer, for example £100,

[9] TMS [3] will make note of the Payment and verify if enough funds are available to carry out the instruction.

[10] TMS will issue the transfer instructions together with Sender (Hirett’s e-Wallet account holder) and Receptionist (Beneficiary as identified by Hirett’s e-Wallet account holder) details via API to CurrencyCloud Direct.

https://www.currencycloud.com/product/currencycloud-direct/

[11] Hirett safeguarding bank account will then push the money in to the pre-funded CurrencyCloud Direct bank account

[12] Based on instructions received from TMS, Hirett’s commission on the transaction will be deducted from e-wallet Account holders account and transferred from the safeguarding bank account to their Current bank account.

[13] CurrencyCloud Direct will then push the money in to Beneficiary bank account and update TMS via API

Please note that the use of CurrencyCloud Direct is for illustrative purposes only.

10. Netting & Settlement Flow

[1] Hirett’s client pre-funds their electronic wallet accounts by transferring money from their respective bank accounts into Hirett’s safeguarding bank account. This could take place on the day of the transaction or before. Here “x” represents an average time delay of 10 seconds.

[2] Hirett’s TMS updates the client’s records and balance details.

[3] This is the day and time of the transaction taking place

[4] The settlement party receives the settlement instructions from Hirett’s TMS and acts accordingly. Here “x” represents an average time delay of 10 seconds.

[5] Netting & settlement reports are issued and TMS is updated.

Hirett is registered at: Kemp House,

160 City Road, London,

EC1V 2NX

The business will be managed and run from the same registered office (address as above)

Hirett will not have any face-to-face contact with end-users. All transactions will be processed via their web site and mobile app (to be developed later)

12. Passporting

Hirett intends to utilise the benefits of being an Authorised e-money institution and to passport into other European countries.

Hirett will initially use the license to extend its services into Italy, Spain, France and Germany through their website, which will be adopted to meet each country specific local requirements. These European countries have been identified due to the overlap in the target market with those in the UK.

13. Funds Required

In order to meet with the financial requirements for an AEMI License, together with additional payment services under Section 6.2 of the AEMI Application, Hirett requires a minimum initial capital of

€350,000. The capital requirements for the running of the business have been calculated using Methods

D. The results from these calculations are in Appendix 4.3.

Total funds of c.£500,000 will be deposited by Hirett as initial capital in order to become an AEMI, which is also greater than the threshold required when using Method D in the calculations for on-going capital requirements. We will supply proof of funds prior to authorisation being granted.

14. Fund Sources

Hirett is 100% owned by the CEO and Director Ms Marianna Luisi. 100% of the required funding for launching and operating Hirett will come directly from Marianna Luisi.

15. Key Financial Assumptions

Hirett has adopted a conservative approach in preparing the financials to accompany its business plan. However, after the initial launch and start-up phase which would require significant marketing effort and set-up costs, Hirett hopes to gain momentum and generate strong sales and good net profit margins.

Revenues

The main sources of revenues considered for the financials are:

• Card issuance fee.

• Transactions fee on commercial transactions where Hirett will receives a percentage fee on each transaction in the form of intracharge fee.

• Exchange rates: We plan to form a partnership with a specialized operator (similar for example to TransferWise, Currency Cloud, etc), for the management of foreign currency payments. This would, allows Hirett to obtain a percentage of the FX margin as well as charge a transaction fee.

• Fee to top up the Hirett card with a credit card (Hp.: 1%)

• ATM withdrawal surcharge (tbd)

• Monthly fee for ‘Premium’ cardholders, as well as for Business Customers (this is a subscription- based web service that enables companies to manage international payments and corporate travel)

Costs

The main costs elements are:

• Customer acquisition costs

• Support and Maintenance to the platform (which will be SaaS)

• Employee related costs

• Other costs, including, marketing costs, premises, and general administrative costs.

16. Start-up Summary

We want to fuel our growth, invest in the product and market expansion. As a virtual bank of the future we believe we can take our platform to the next level by increasing the usage of artificial intelligence. Banking will be even smarter and more personalised than it is today, products will be customised to the individual needs. The AI will allow us to become more adaptive to customers’ needs and, based on their financial behaviour, solve problems in a way that is currently missing in the industry.

We plan to re-design banking for the smartphone, not just to develop another interface:

• Every feature or product must be available with only one or two clicks directly in our app.

• All processes (credit checks, signing up for our services, fixed-term savings or investments, when available) must take place in real-time.

• Our customers must be able to lock and unlock their cards, as well as change their pin, within the app.

• Everything including KYC must be fully digital without the need of any physical paperwork.

• Opening an account must take no more than few minutes and could take place anytime of the day or night.

Furthermore, Hirett would offer:

• competitive exchange rates on multiple international currencies, making spending in different countries very simple.

• Instant and free domestic and international money transfers

• Monthly fee for packages of free international ATM withdrawals with a fee thereafter (tbd)

• Instant credit to any Hirett account in minutes worldwide

The success of the Hirett Project will be linked to the ability to achieve in a coordinated manner the different aspects of the implementation of IT infrastructures, platforms and services to be offered to customers.

At the same time, it will be banking from ground-up. This would include:

• real time mobile best class experience

• account opening in matter of minutes, all day or night (the confirmation from Hirett might come later when KYC is performed and verified)

• always running verification checks, risk scoring, whitelist / blacklist

• the almost instantaneous transfer of money

• total transparency, which in turn means building a system of intelligent push notifications in order to inform the customer about for example:

o successful card & bank transactions

o fraud attempts,

o insufficient funds or exceeded limits

• real time control, giving the wallet holders the possibility of:

o block their cards and report it as stolen

o set whether he wants to pay abroad (or online)

o allow cash withdrawal or not

Last but not least, Hirett will have in the dedicated chat service one of the main pillars of his proposition.

Hirett has an enormous upside potential and is poised for rapid growth. By securing agreements with companies that host large numbers of merchants, Hirett will raise high entry barriers for possible competition and will significantly minimize the replication factor.